Semiconductor design software provider Cadence Design Systems (NASDAQ:CDNS) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 26.9% year on year to $1.36 billion. On the other hand, the company’s full-year revenue guidance of $5.18 billion at the midpoint came in 1.3% below analysts’ estimates. Its non-GAAP profit of $1.88 per share was 3.2% above analysts’ consensus estimates.

Is now the time to buy Cadence? Find out by accessing our full research report, it’s free.

Cadence (CDNS) Q4 CY2024 Highlights:

- Revenue: $1.36 billion vs analyst estimates of $1.35 billion (26.9% year-on-year growth, in line)

- Adjusted EPS: $1.88 vs analyst estimates of $1.82 (3.2% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $5.18 billion at the midpoint, missing analyst estimates by 1.3% and implying 11.6% growth (vs 13.3% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $6.70 at the midpoint, missing analyst estimates by 2%

- Operating Margin: 33.7%, up from 31.5% in the same quarter last year

- Free Cash Flow Margin: 29.8%, down from 31.5% in the previous quarter

- Market Capitalization: $80.65 billion

“Cadence delivered exceptional results in the fourth quarter, capping off a strong 2024 with 13.5% revenue growth and 42.5% non-GAAP operating margin for the year,” said Anirudh Devgan, president and chief executive officer.

Company Overview

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

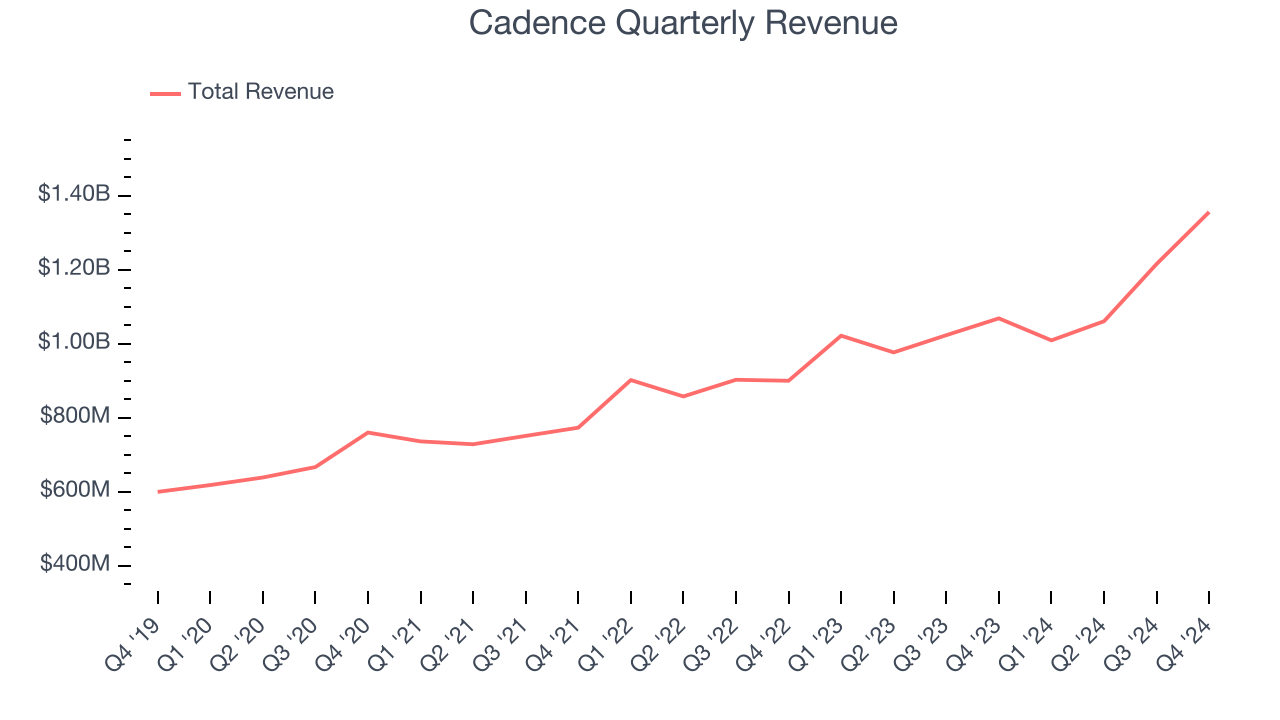

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Cadence grew its sales at a 15.8% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our benchmark for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Cadence.

This quarter, Cadence’s year-on-year revenue growth of 26.9% was excellent, and its $1.36 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 12.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and implies the market sees some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Cadence is extremely efficient at acquiring new customers, and its CAC payback period checked in at 2.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Cadence’s Q4 Results

Revenue was in line and EPS beat. However, full-year revenue and full-year EPS guidance were both below expectations. This outlook weighed on shares. The stock traded down 5.1% to $284.98 immediately after reporting.

Cadence’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.