Restaurant software platform Toast (NYSE:TOST) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 29.2% year on year to $1.34 billion. Its GAAP profit of $0.05 per share was in line with analysts’ consensus estimates.

Is now the time to buy Toast? Find out by accessing our full research report, it’s free.

Toast (TOST) Q4 CY2024 Highlights:

- Revenue: $1.34 billion vs analyst estimates of $1.32 billion (29.2% year-on-year growth, 1.5% beat)

- EPS (GAAP): $0.05 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: $111 million vs analyst estimates of $99.39 million (8.3% margin, 11.7% beat)

- EBITDA guidance for the upcoming financial year 2025 is $520 million at the midpoint, above analyst estimates of $511.1 million

- Operating Margin: 2.4%, up from -5.4% in the same quarter last year

- Free Cash Flow Margin: 10%, up from 7.4% in the previous quarter

- Annual Recurring Revenue: $1.63 billion at quarter end, up 33.5% year on year

- Market Capitalization: $22.58 billion

“Toast had a strong close to 2024, capping off a transformational year where we added a record 28,000 net locations, grew our recurring gross profit streams1 34%, delivered Adjusted EBITDA of $373 million, and achieved our first year of GAAP profitability,” said Toast CEO and Co-Founder Aman Narang.

Company Overview

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Hospitality & Restaurant Software

Enterprise resource planning (ERP) and customer relationship management (CRM) are two of the largest software categories dominated by the likes of Microsoft, Oracle, and Salesforce.com. Today, the secular trend of mass customization is driving vertical software that customizes ERP and CRM functions for specific industry requirements. Restaurants are a prime example where a set of customized software providers have sprung up in recent years to create unique operating systems that blend tax and accounting software, order management and delivery, along with supply chain management. Hotels and other hospitality providers are another example.

Sales Growth

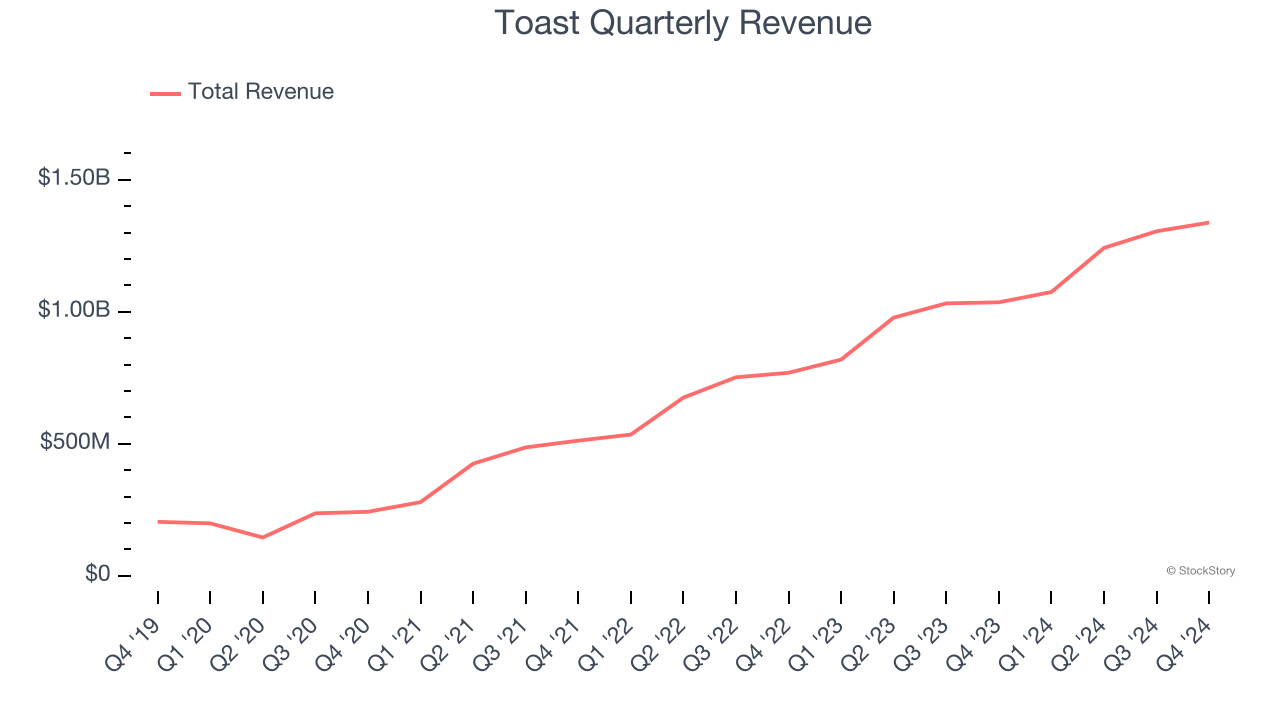

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Toast’s sales grew at an incredible 42.8% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Toast reported robust year-on-year revenue growth of 29.2%, and its $1.34 billion of revenue topped Wall Street estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 23.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

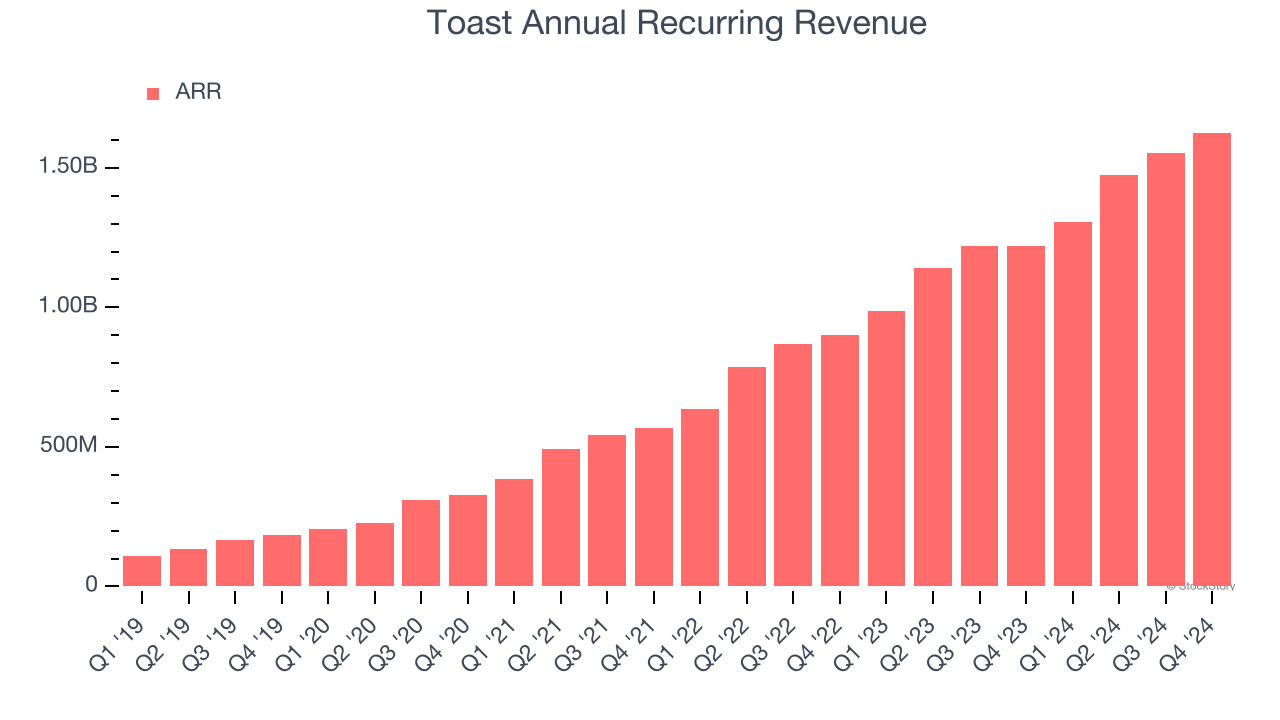

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Toast’s ARR punched in at $1.63 billion in Q4, and over the last four quarters, its growth was fantastic as it averaged 30.6% year-on-year increases. This alternate topline metric grew faster than total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Toast is very efficient at acquiring new customers, and its CAC payback period checked in at 26.9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Toast more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Toast’s Q4 Results

We were impressed by Toast’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock remained flat at $40.00 immediately following the results.

Indeed, Toast had a rock-solid quarterly earnings result, but is this stock a good investment here? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.