Finance and HR software company Workday (NASDAQ:WDAY) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 15% year on year to $2.21 billion. Its non-GAAP profit of $1.92 per share was 8.1% above analysts’ consensus estimates.

Is now the time to buy Workday? Find out by accessing our full research report, it’s free.

Workday (WDAY) Q4 CY2024 Highlights:

- Revenue: $2.21 billion vs analyst estimates of $2.18 billion (15% year-on-year growth, 1.3% beat)

- Adjusted EPS: $1.92 vs analyst estimates of $1.78 (8.1% beat)

- Adjusted Operating Income: $584 million vs analyst estimates of $547.4 million (26.4% margin, 6.7% beat)

- Operating Margin: 3.4%, in line with the same quarter last year

- Free Cash Flow Margin: 46.4%, up from 16.6% in the previous quarter

- Billings: $3.25 billion at quarter end, up 16.4% year on year

- Market Capitalization: $69.64 billion

"Our fourth quarter performance is a testament to Workday's value proposition as organizations seek to boost productivity, run more efficiently, and deliver incredible employee experiences," said Carl Eschenbach, CEO, Workday.

Company Overview

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Finance and Accounting Software

Finance and accounting software benefits from dual trends around costs savings and ease of use. First is the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software. Second is the consumerization of business software, whereby multiple standalone processes like supply chain and tax management are aggregated into a single, easy to use platforms.

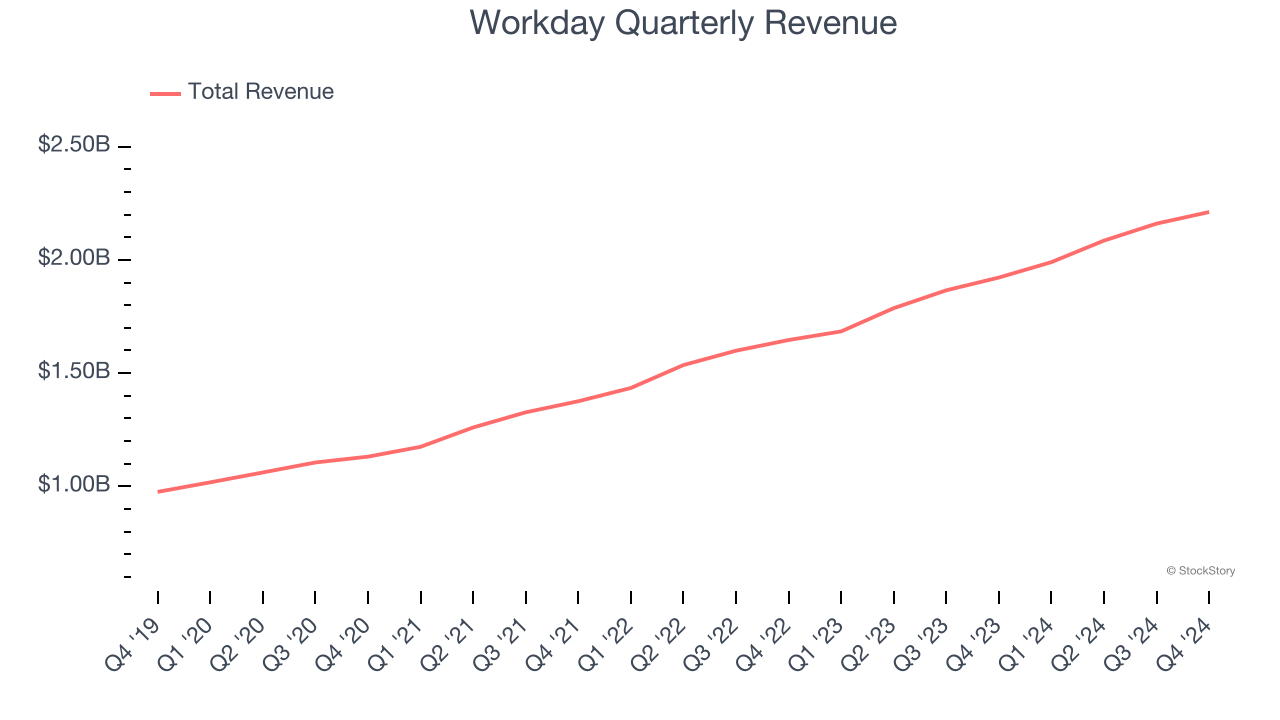

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Workday grew its sales at a 18% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Workday.

This quarter, Workday reported year-on-year revenue growth of 15%, and its $2.21 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

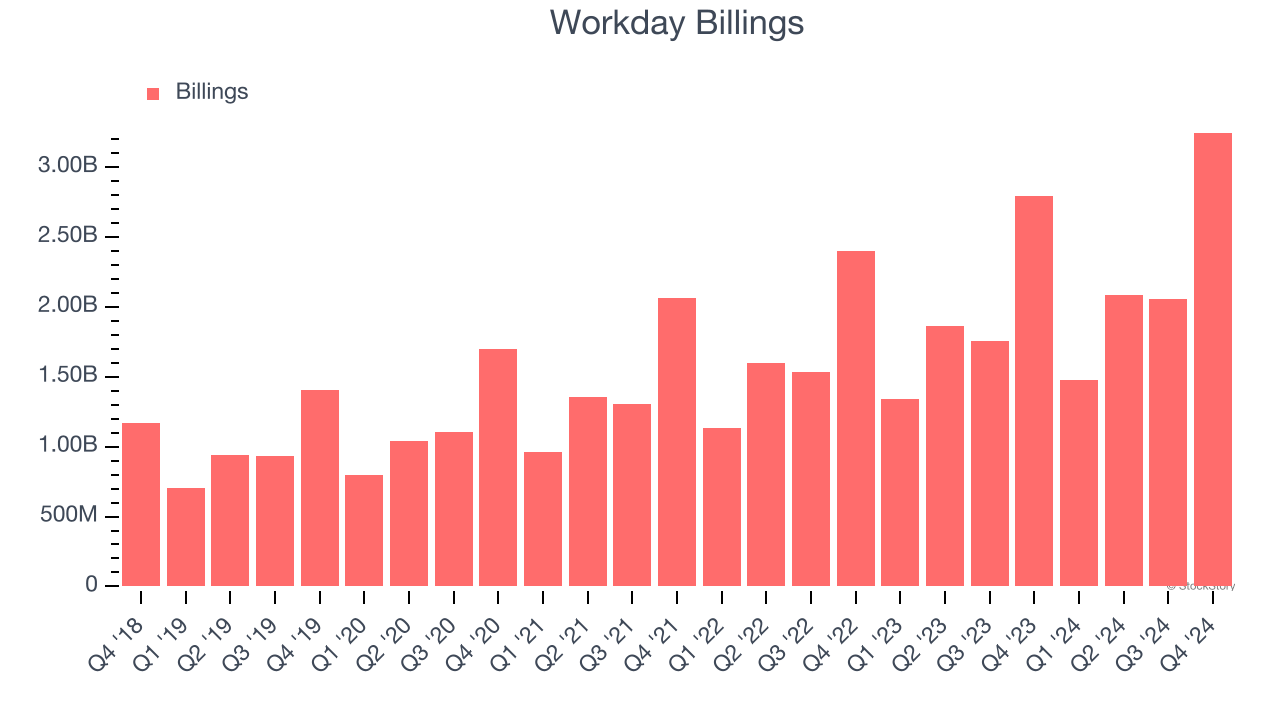

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Workday’s billings punched in at $3.25 billion in Q4, and over the last four quarters, its growth slightly outpaced the sector as it averaged 13.9% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

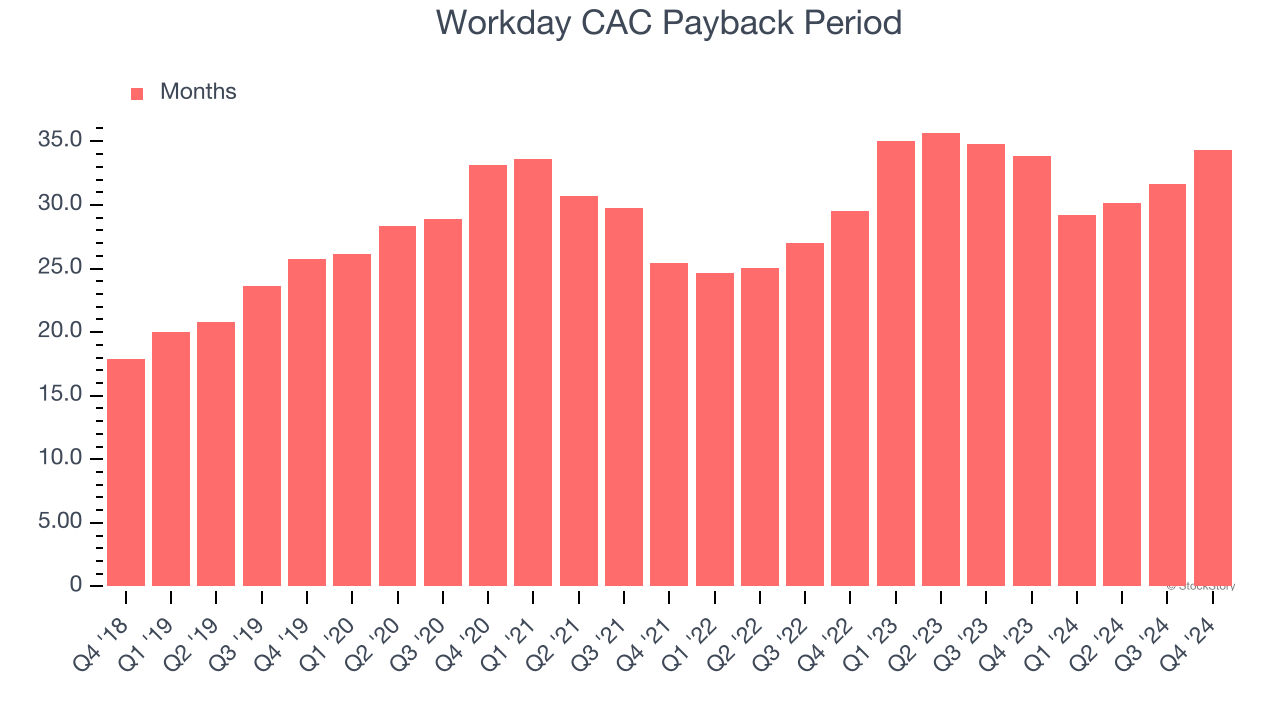

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Workday is quite efficient at acquiring new customers, and its CAC payback period checked in at 34.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a strong brand reputation, giving it more resources pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Workday’s Q4 Results

We enjoyed seeing Workday beat analysts’ billings expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 6.4% to $271.37 immediately following the results.

Indeed, Workday had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.