Electricity generation and hydrogen production company Bloom Energy (NYSE:BE) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 60.4% year on year to $572.4 million. The company’s full-year revenue guidance of $1.75 billion at the midpoint came in 3.6% above analysts’ estimates. Its non-GAAP profit of $0.43 per share was 39.9% above analysts’ consensus estimates.

Is now the time to buy Bloom Energy? Find out by accessing our full research report, it’s free.

Bloom Energy (BE) Q4 CY2024 Highlights:

- Revenue: $572.4 million vs analyst estimates of $507.3 million (60.4% year-on-year growth, 12.8% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.31 (39.9% beat)

- Adjusted EBITDA: $147.3 million vs analyst estimates of $108 million (25.7% margin, 36.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.75 billion at the midpoint, beating analyst estimates by 3.6% and implying 18.7% growth (vs 10% in FY2024)

- Operating Margin: 18.3%, up from 3.6% in the same quarter last year

- Free Cash Flow Margin: 82.7%, up from 29.6% in the same quarter last year

- Market Capitalization: $5.35 billion

KR Sridhar, Founder, Chairman, and CEO of Bloom Energy said, “We are the solution of choice for powering AI, whether that’s large data centers that need reliable power now, or businesses that are going to use AI for productivity gains. Our proven solution is ready to be deployed at GW scale starting this year.”

Company Overview

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

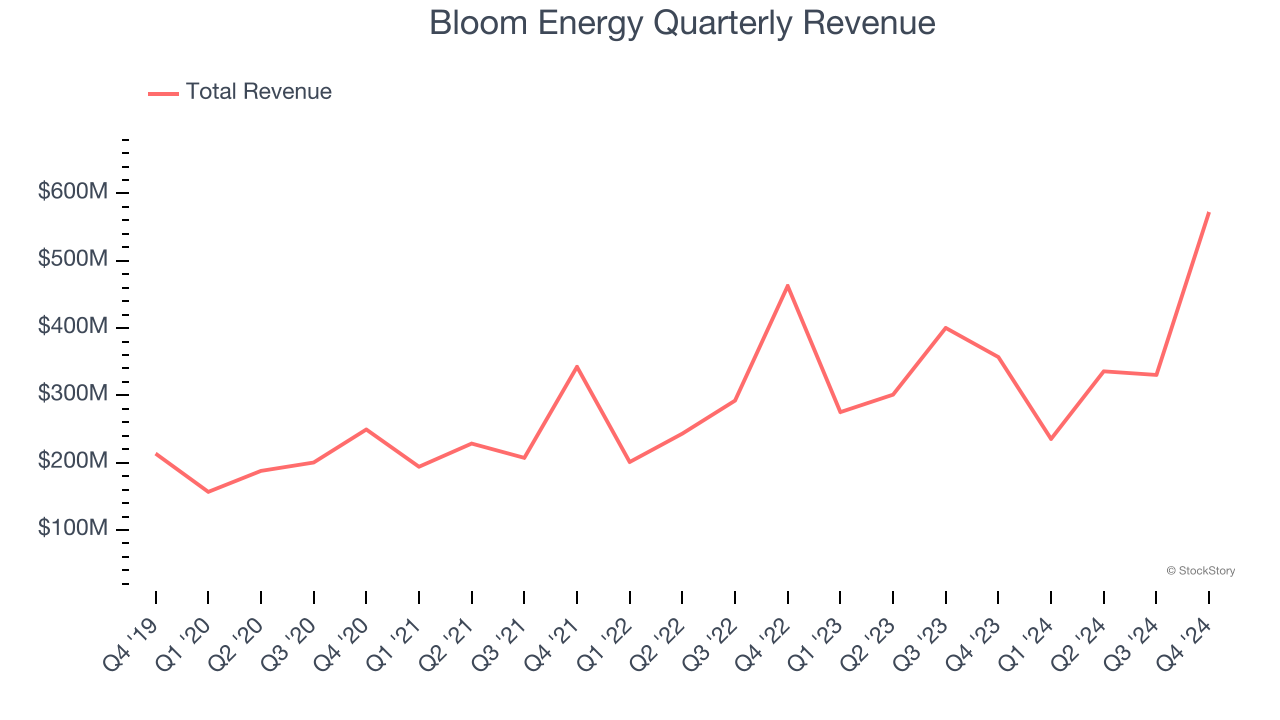

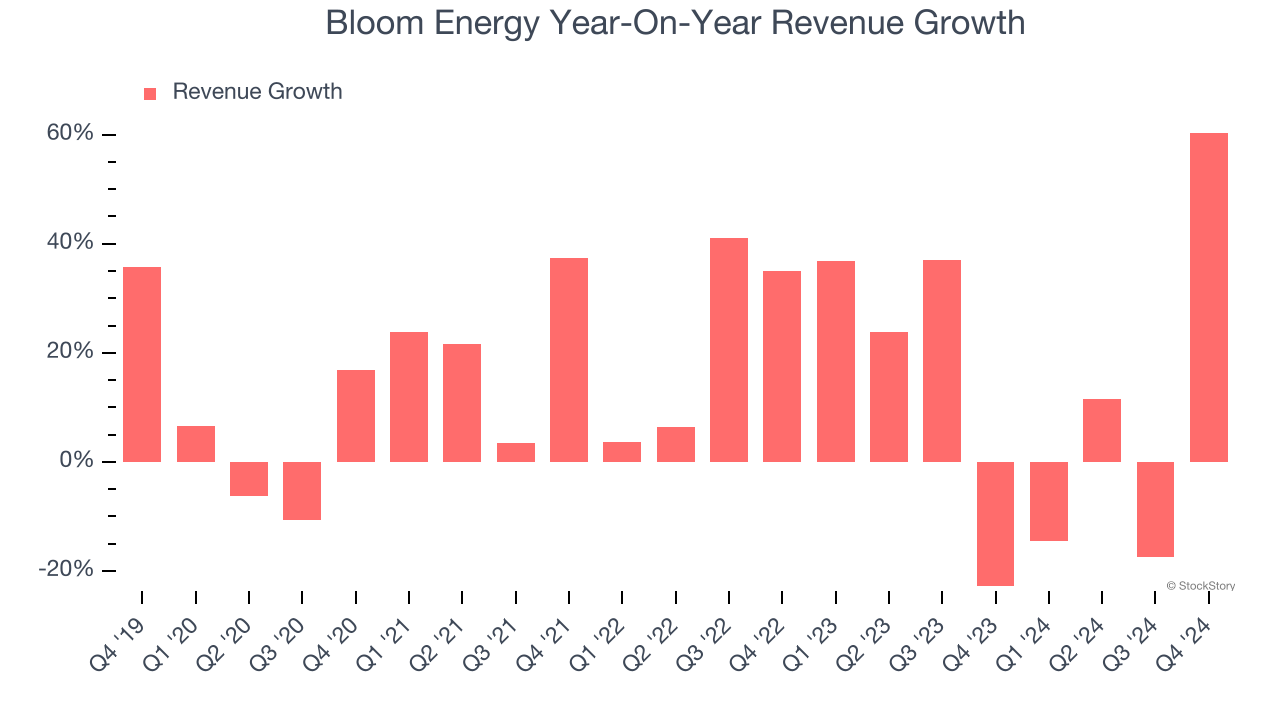

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Bloom Energy’s 13.4% annualized revenue growth over the last five years was excellent. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Bloom Energy’s annualized revenue growth of 10.9% over the last two years is below its five-year trend, but we still think the results were good and suggest demand was strong. Bloom Energy recent history stands out, especially when considering many similar Renewable Energy businesses faced declining sales because of cyclical headwinds.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Product. Over the last two years, Bloom Energy’s Product revenue (energy servers and electrolyzers) averaged 15.7% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Bloom Energy reported magnificent year-on-year revenue growth of 60.4%, and its $572.4 million of revenue beat Wall Street’s estimates by 12.8%.

Looking ahead, sell-side analysts expect revenue to grow 12.4% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

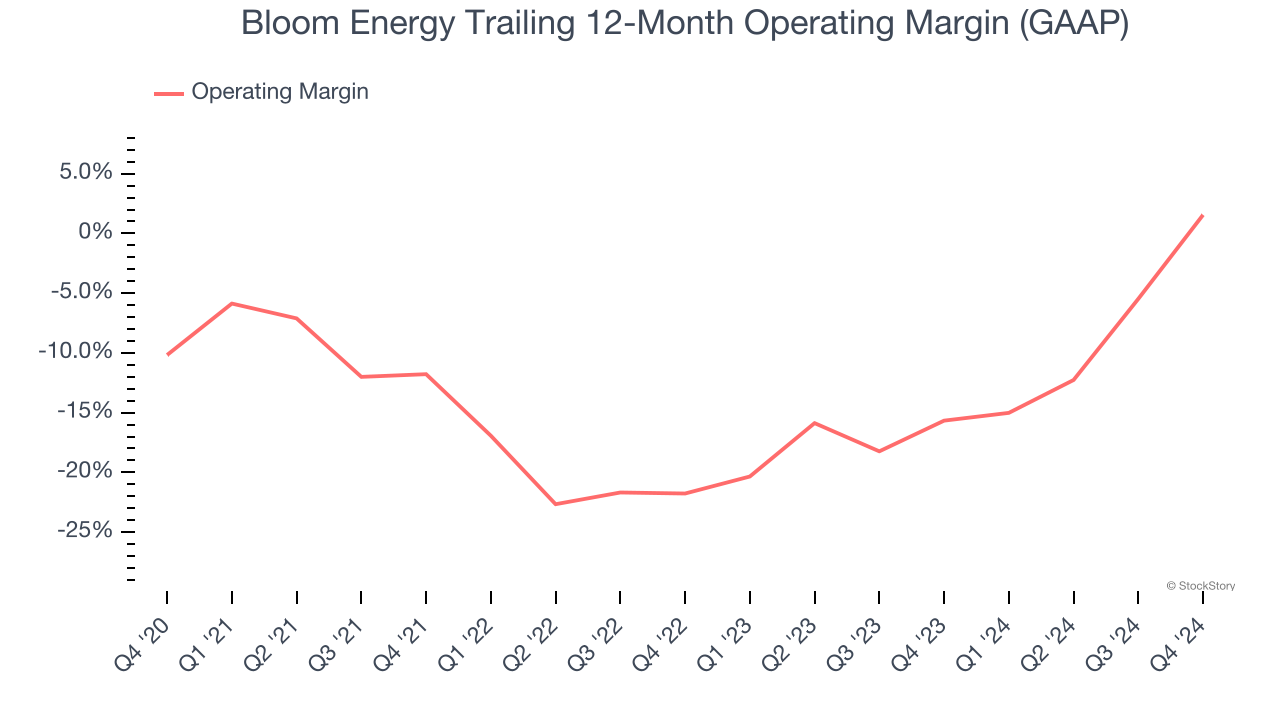

Operating Margin

Although Bloom Energy was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 11.1% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Bloom Energy’s operating margin rose by 11.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

This quarter, Bloom Energy generated an operating profit margin of 18.3%, up 14.7 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

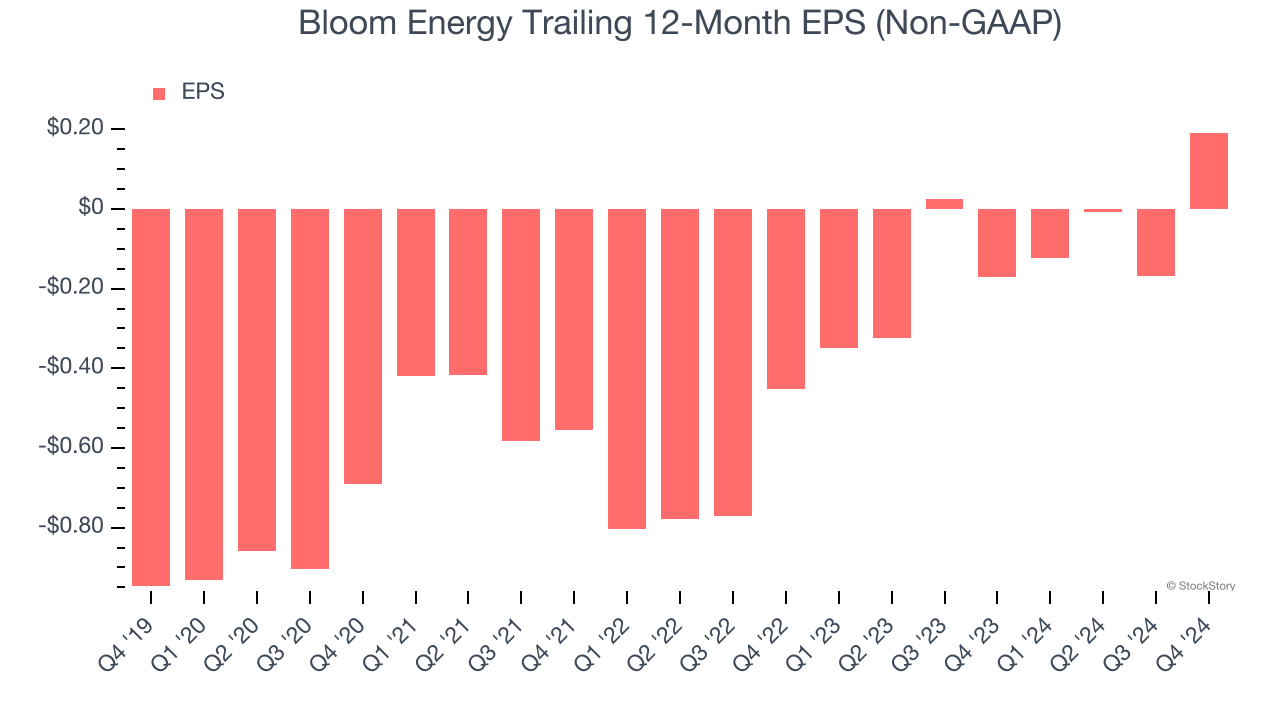

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Bloom Energy’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Bloom Energy, its two-year annual EPS growth of 55.7% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, Bloom Energy reported EPS at $0.43, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Bloom Energy to perform poorly. Analysts forecast its full-year EPS of $0.19 will hit $0.40.

Key Takeaways from Bloom Energy’s Q4 Results

We were impressed by how significantly Bloom Energy blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 11.2% to $25.58 immediately following the results.

Bloom Energy may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.