Healthcare apparel company Figs (NYSE:FIGS) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 4.8% year on year to $151.8 million. Its non-GAAP profit of $0.01 per share was in line with analysts’ consensus estimates.

Is now the time to buy Figs? Find out by accessing our full research report, it’s free.

Figs (FIGS) Q4 CY2024 Highlights:

- Revenue: $151.8 million vs analyst estimates of $139.8 million (4.8% year-on-year growth, 8.6% beat)

- Adjusted EPS: $0.01 vs analyst estimates of $0.01 (in line)

- Adjusted EBITDA: $21.08 million vs analyst estimates of $12.73 million (13.9% margin, 65.5% beat)

- Revenue guidance for the upcoming financial year 2025 of a low-single-digit percentage decline (miss)

- EBITDA guidance for the upcoming financial year 2025 is $50.35 million at the midpoint, below analyst estimates of $60.77 million

- Operating Margin: 5.9%, down from 9.8% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 9.4% in the same quarter last year

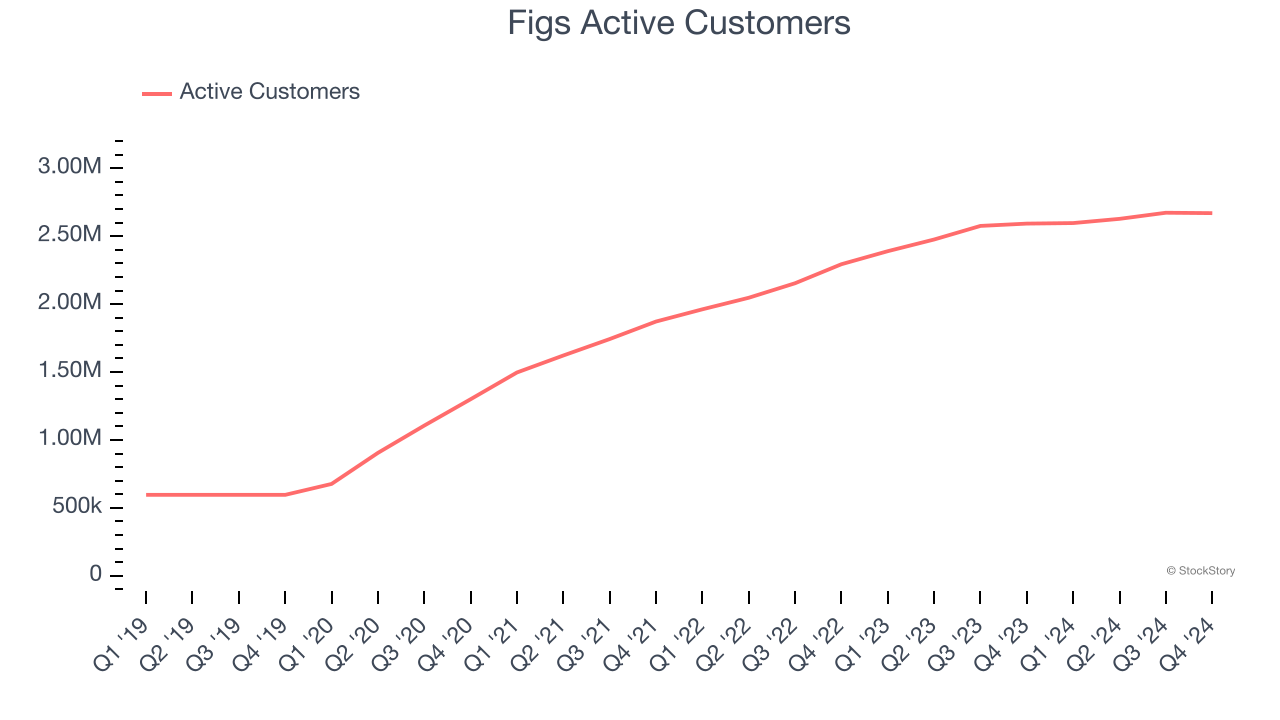

- Active Customers: 2.67 million, up 77,000 year on year

- Market Capitalization: $967.9 million

“We finished the year with solid momentum, as our fourth quarter results exceeded our expectations and were powered by an impactful flow of product newness driving repeat frequency,” said Trina Spear, Chief Executive Officer and Co-Founder.

Company Overview

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE:FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

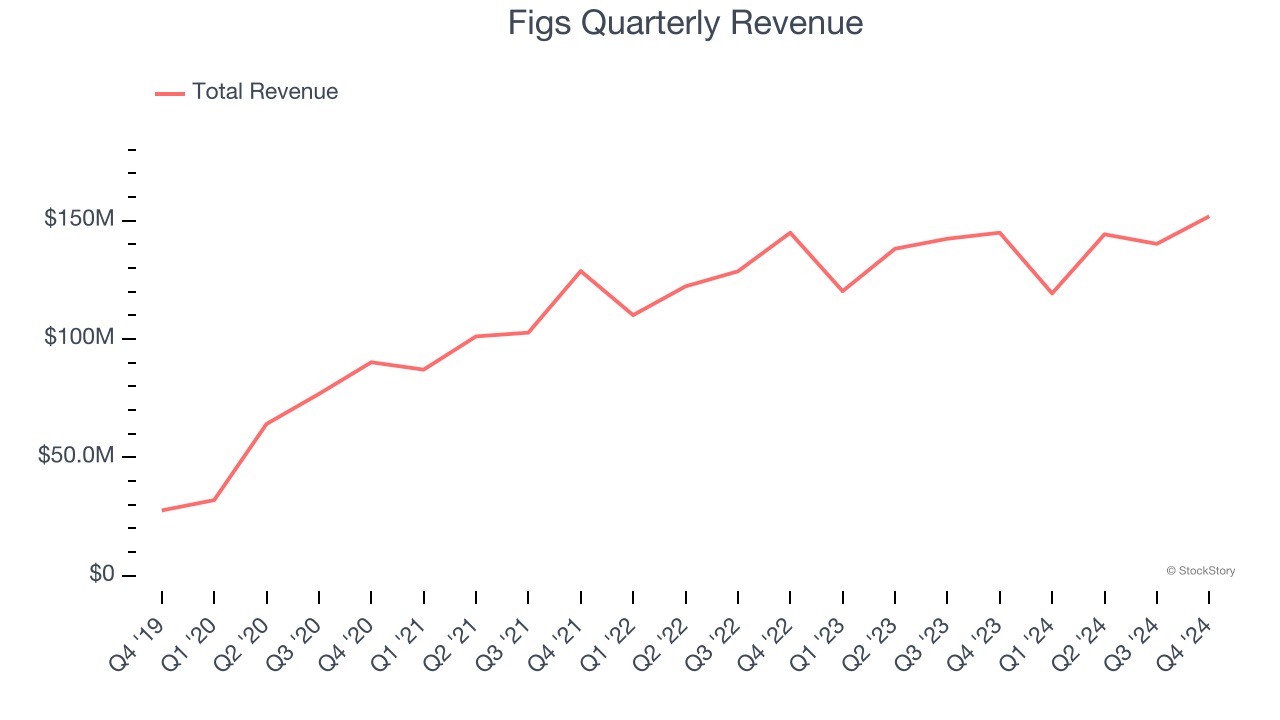

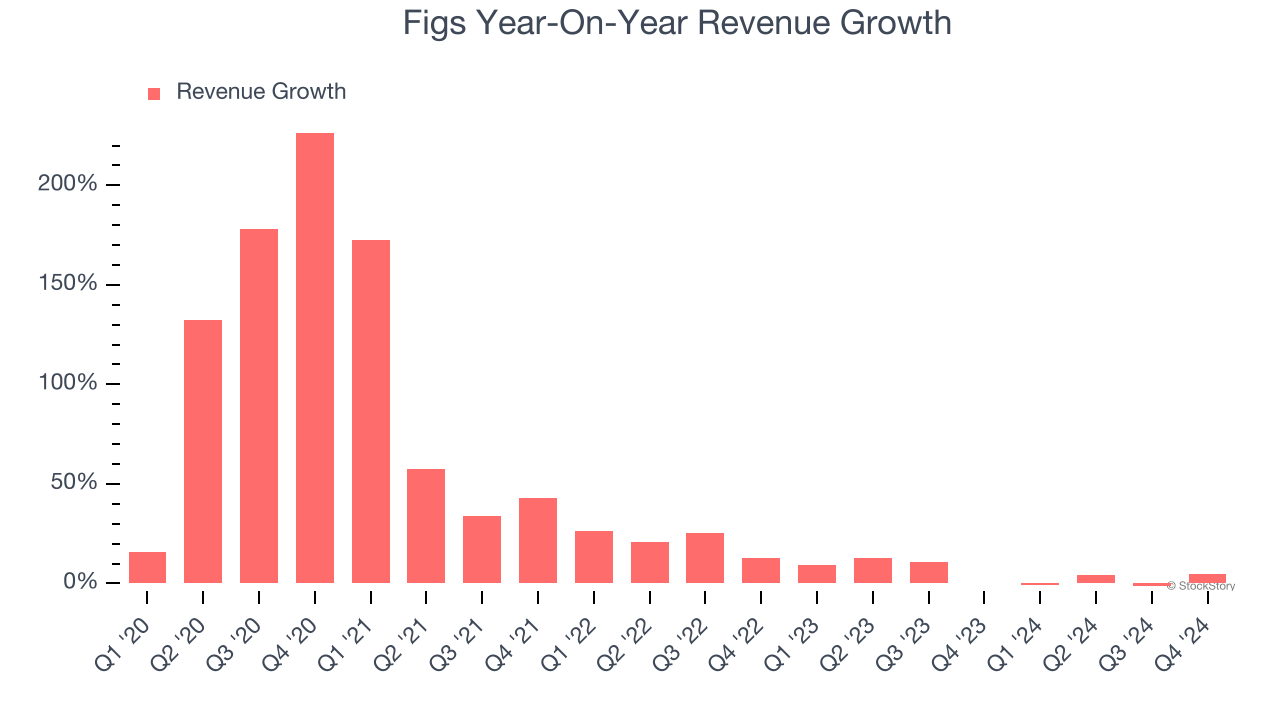

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Figs’s 38.1% annualized revenue growth over the last five years was incredible. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Figs’s recent history shows its demand slowed significantly as its annualized revenue growth of 4.8% over the last two years is well below its five-year trend.

We can dig further into the company’s revenue dynamics by analyzing its number of active customers, which reached 2.67 million in the latest quarter. Over the last two years, Figs’s active customers averaged 12.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Figs reported modest year-on-year revenue growth of 4.8% but beat Wall Street’s estimates by 8.6%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

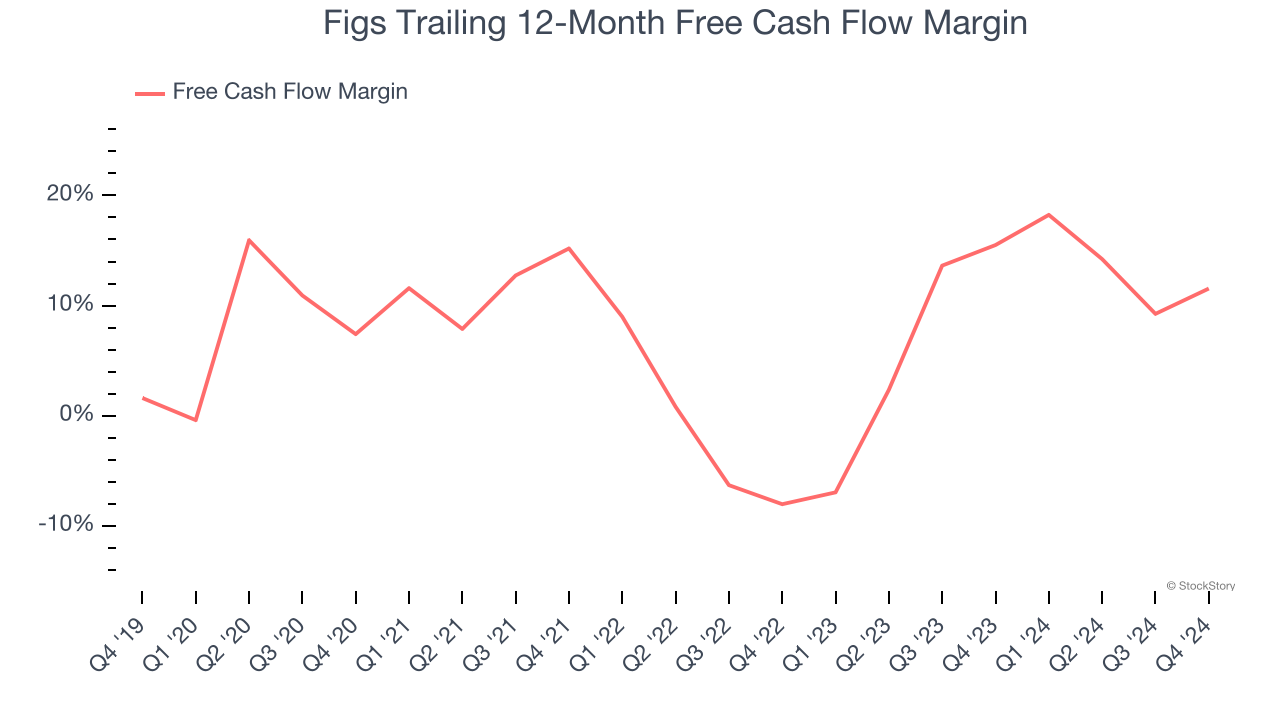

Figs has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.5% over the last two years, better than the broader consumer discretionary sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Figs’s free cash flow clocked in at $27.05 million in Q4, equivalent to a 17.8% margin. This result was good as its margin was 8.4 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts’ consensus estimates show they’re expecting Figs’s free cash flow margin of 11.5% for the last 12 months to remain the same.

Key Takeaways from Figs’s Q4 Results

We were impressed by how significantly Figs beat analysts’ revenue and EBITDA expectations this quarter. On the other hand, its full-year revenue and EBITDA guidance missed. Overall, this was a mixed quarter. The stock traded up 1.4% to $5.68 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.