Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Sterling (NASDAQ:STRL) and the best and worst performers in the engineering and design services industry.

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 5 engineering and design services stocks we track reported a strong Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% below.

While some engineering and design services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2% since the latest earnings results.

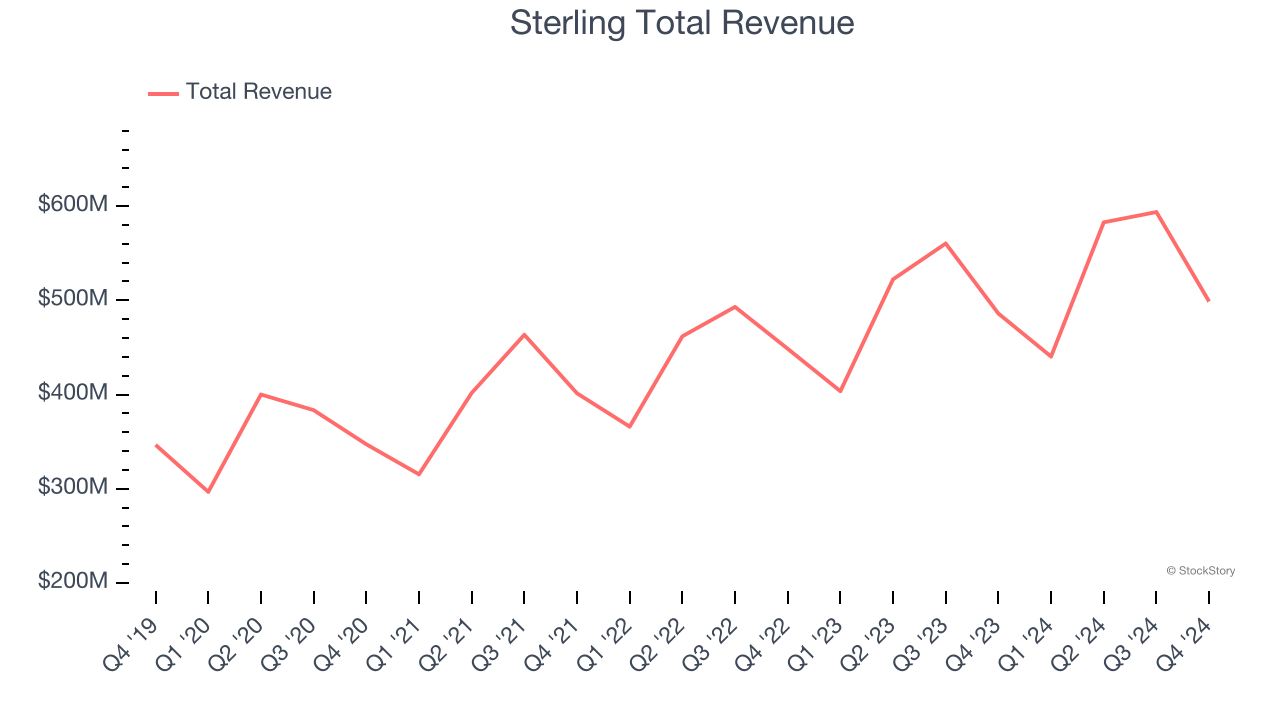

Sterling (NASDAQ:STRL)

Involved in the construction of a major highway, the Grand Parkway in Houston, TX, Sterling Infrastructure (NASDAQ:STRL) provides civil infrastructure construction.

Sterling reported revenues of $498.8 million, up 2.6% year on year. This print fell short of analysts’ expectations by 6.1%, but it was still a strong quarter for the company with full-year EBITDA guidance exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

Sterling delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update of the whole group. Interestingly, the stock is up 3.5% since reporting and currently trades at $120.36.

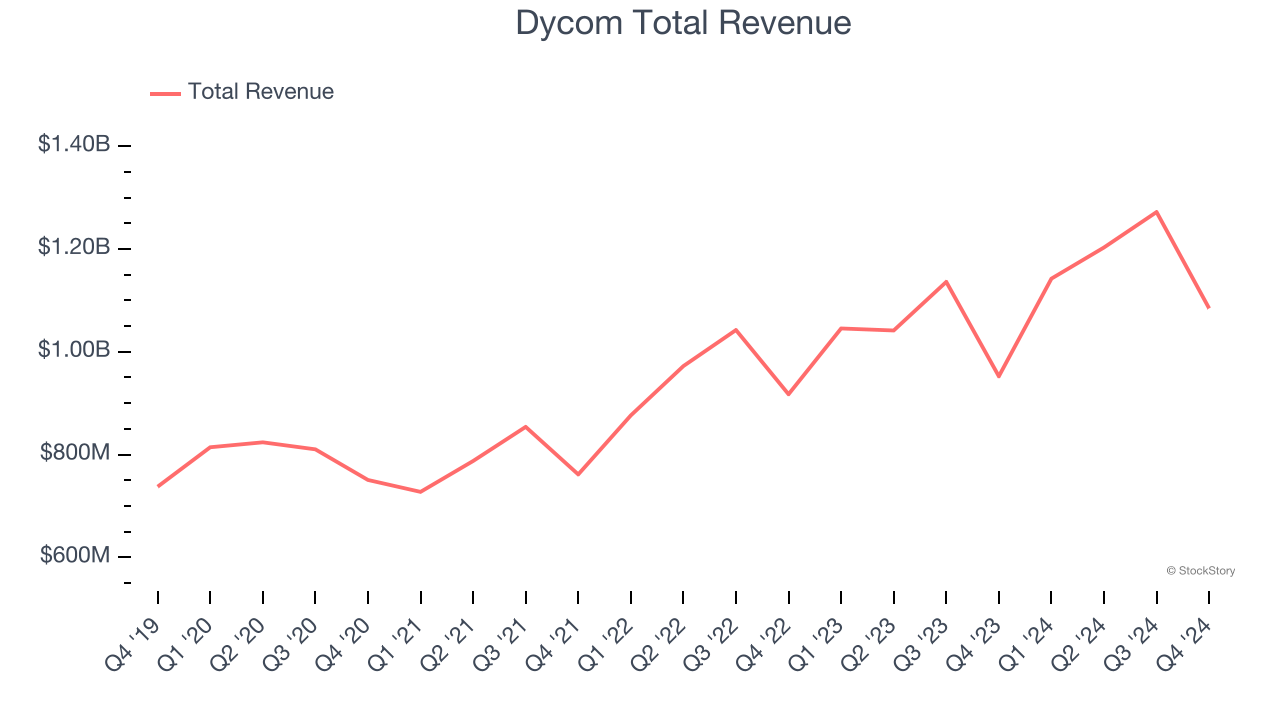

Best Q4: Dycom (NYSE:DY)

Working alongside some of the most popular mobile carriers in the world, Dycom (NYSE:DY) builds and maintains telecommunications infrastructure.

Dycom reported revenues of $1.08 billion, up 13.9% year on year, outperforming analysts’ expectations by 5.7%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Dycom delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 6.4% since reporting. It currently trades at $160.52.

Is now the time to buy Dycom? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AECOM (NYSE:ACM)

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE:ACM) provides various infrastructure consulting services.

AECOM reported revenues of $4.01 billion, up 2.9% year on year, falling short of analysts’ expectations by 2.3%. It was a mixed quarter as it posted an impressive beat of analysts’ EPS estimates but adjusted operating income in line with analysts’ estimates.

As expected, the stock is down 6.5% since the results and currently trades at $97.21.

Read our full analysis of AECOM’s results here.

MasTec (NYSE:MTZ)

Involved in the 1996 Olympic Games MasTec (NYSE:MTZ) is an infrastructure construction company that specializes in the telecommunications, energy, and utility industries.

MasTec reported revenues of $3.40 billion, up 3.8% year on year. This number topped analysts’ expectations by 2.4%. It was a strong quarter as it also produced an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $127.01.

Read our full, actionable report on MasTec here, it’s free.

EMCOR (NYSE:EME)

Through its network of over 70 subsidiaries, EMCOR (NYSE:EME) provides electrical, mechanical, and building construction and services

EMCOR reported revenues of $3.77 billion, up 9.6% year on year. This result missed analysts’ expectations by 0.6%. Aside from that, it was a very strong quarter as it produced an impressive beat of analysts’ EBITDA estimates.

EMCOR achieved the highest full-year guidance raise among its peers. The stock is flat since reporting and currently trades at $395.

Read our full, actionable report on EMCOR here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.