Electric vehicle charging company EVgo (NASDAQ:EVGO) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 35% year on year to $67.51 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $360 million at the midpoint. Its GAAP loss of $0.11 per share was 13.9% below analysts’ consensus estimates.

Is now the time to buy EVgo? Find out by accessing our full research report, it’s free.

EVgo (EVGO) Q4 CY2024 Highlights:

- Revenue: $67.51 million vs analyst estimates of $69.03 million (35% year-on-year growth, 2.2% miss)

- EPS (GAAP): -$0.11 vs analyst expectations of -$0.10 (13.9% miss)

- Adjusted EBITDA: -$8.40 million vs analyst estimates of -$8.68 million (-12.4% margin, 3.2% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $360 million at the midpoint, in line with analyst expectations and implying 40.2% growth (vs 69.3% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $2.5 million at the midpoint, below analyst estimates of $5.75 million

- Operating Margin: -51.9%, up from -81.6% in the same quarter last year

- Free Cash Flow was -$36.52 million compared to -$42.09 million in the same quarter last year

- Gigawatt-hours Sold: 84, down 50 million year on year

- Market Capitalization: $262.8 million

Company Overview

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ:EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

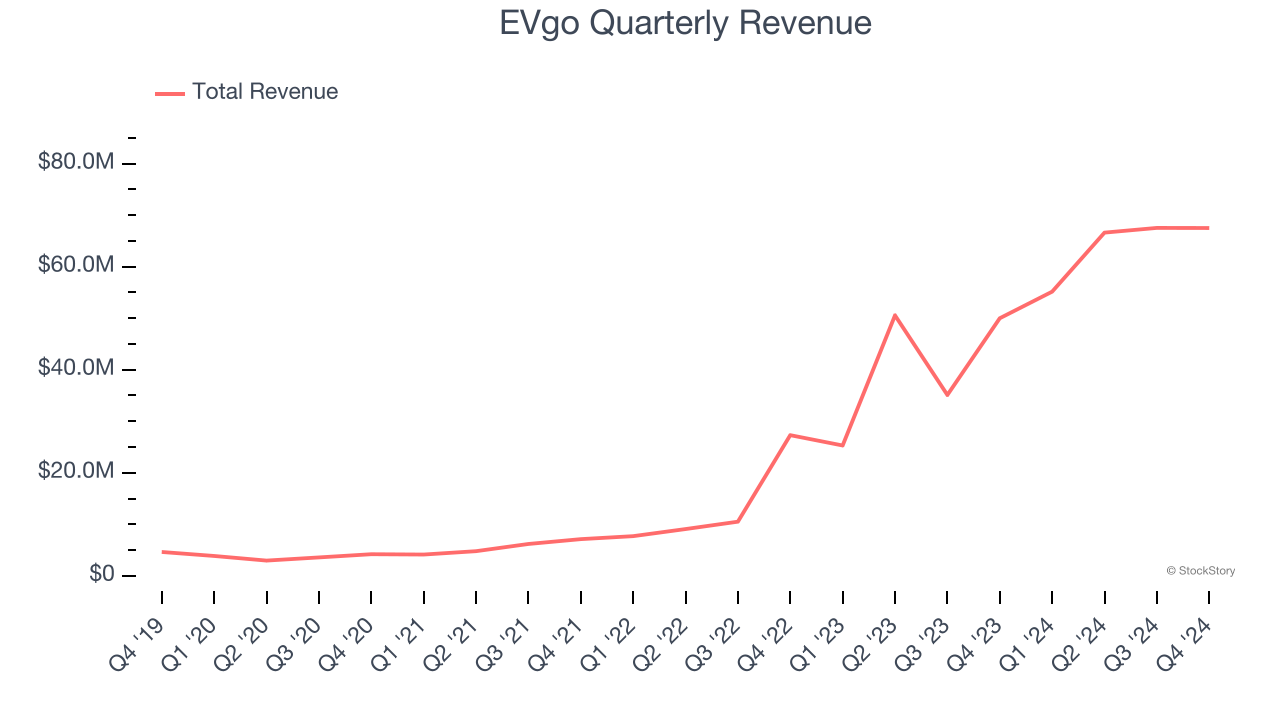

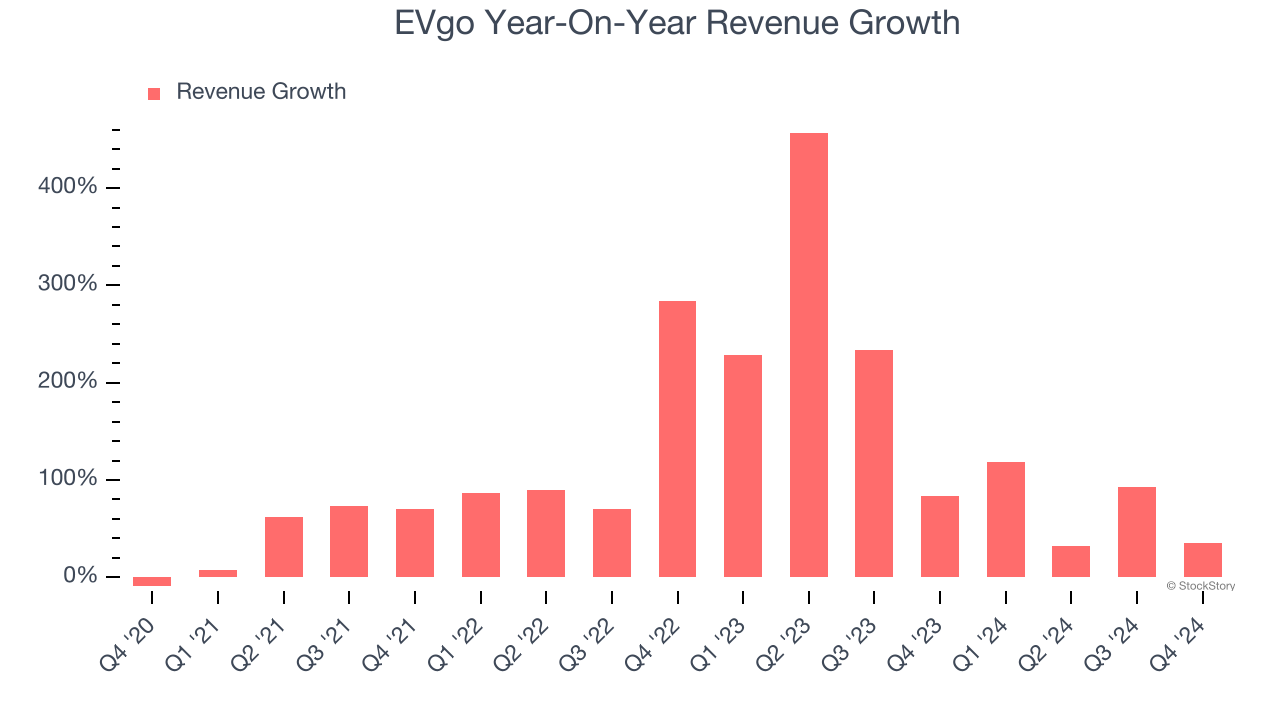

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, EVgo’s sales grew at an incredible 105% compounded annual growth rate over the last four years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. EVgo’s annualized revenue growth of 117% over the last two years is above its four-year trend, suggesting its demand was strong and recently accelerated.

This quarter, EVgo pulled off a wonderful 35% year-on-year revenue growth rate, but its $67.51 million of revenue fell short of Wall Street’s rosy estimates.

Looking ahead, sell-side analysts expect revenue to grow 39.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

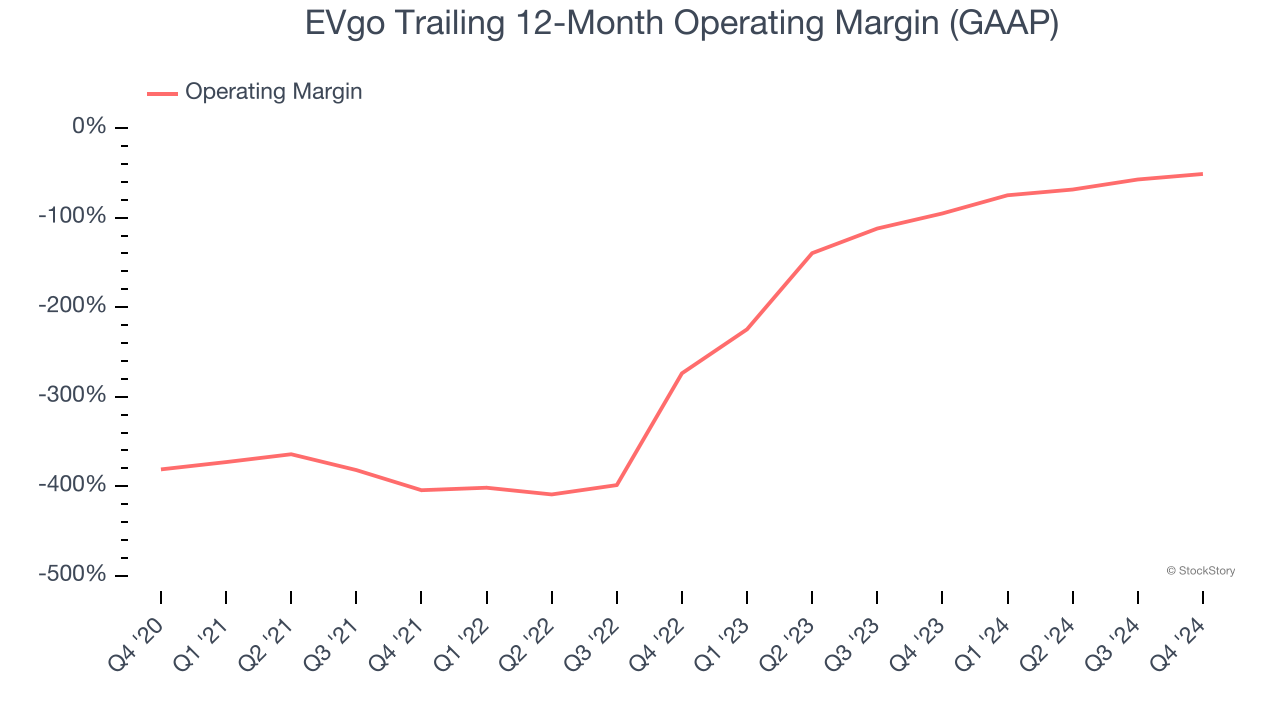

Operating Margin

EVgo’s high expenses have contributed to an average operating margin of negative 114% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, EVgo’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, EVgo generated a negative 51.9% operating margin. The company's consistent lack of profits raise a flag.

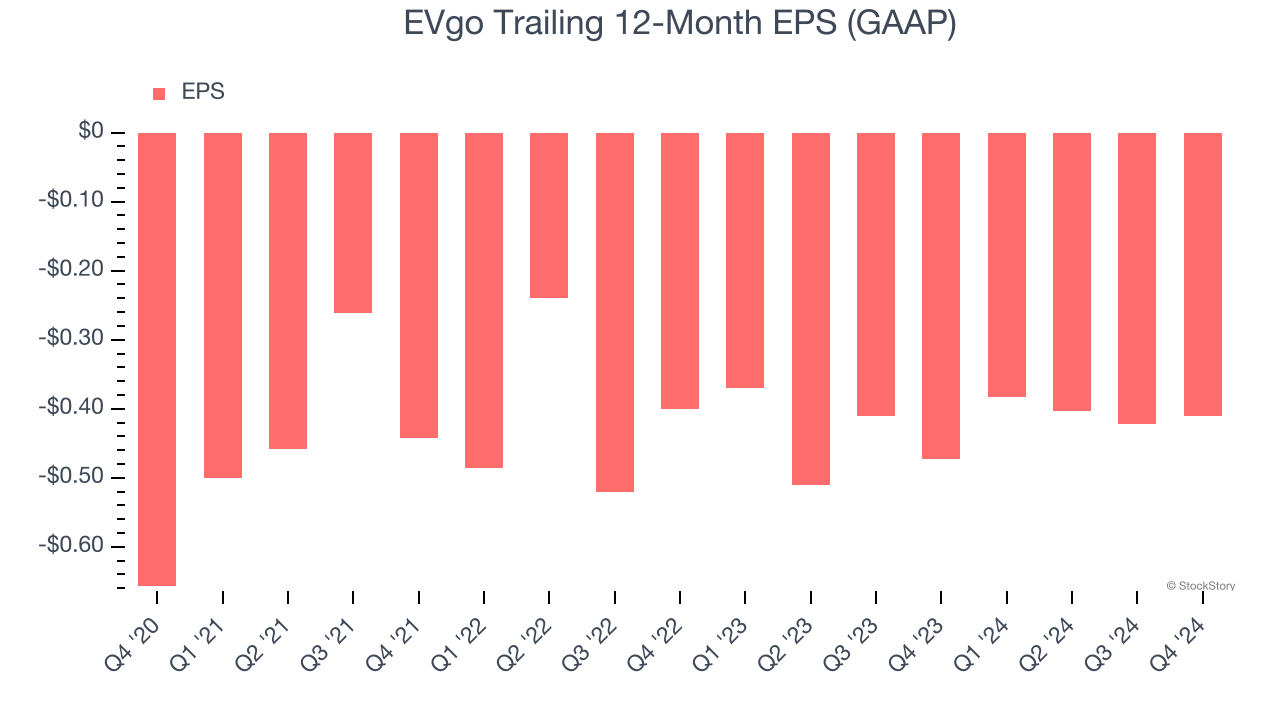

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although EVgo’s full-year earnings are still negative, it reduced its losses and improved its EPS by 11.1% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For EVgo, its two-year annual EPS declines of 1.2% mark a reversal from its (seemingly) healthy four-year trend. These shorter-term results weren’t ideal, but given it was successful in other measures of financial health, we’re hopeful EVgo can return to earnings growth in the future.

In Q4, EVgo reported EPS at negative $0.11, up from negative $0.12 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast EVgo’s full-year EPS of negative $0.41 will reach break even.

Key Takeaways from EVgo’s Q4 Results

Revenue in the quarter missed. While full-year revenue guidance was in line with expectations, full-year EBITDA guidance missed. Overall, this quarter could have been better. The stock traded down 1.6% to $2.41 immediately after reporting.

The latest quarter from EVgo’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.