G-III trades at $26.65 and has moved in lockstep with the market. Its shares have returned 6.4% over the last six months while the S&P 500 has gained 6.2%.

Is now the time to buy G-III, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We're sitting this one out for now. Here are three reasons why we avoid GIII and a stock we'd rather own.

Why Do We Think G-III Will Underperform?

Founded as a small leather goods business, G-III (NASDAQ:GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

1. Long-Term Revenue Growth Flatter Than a Pancake

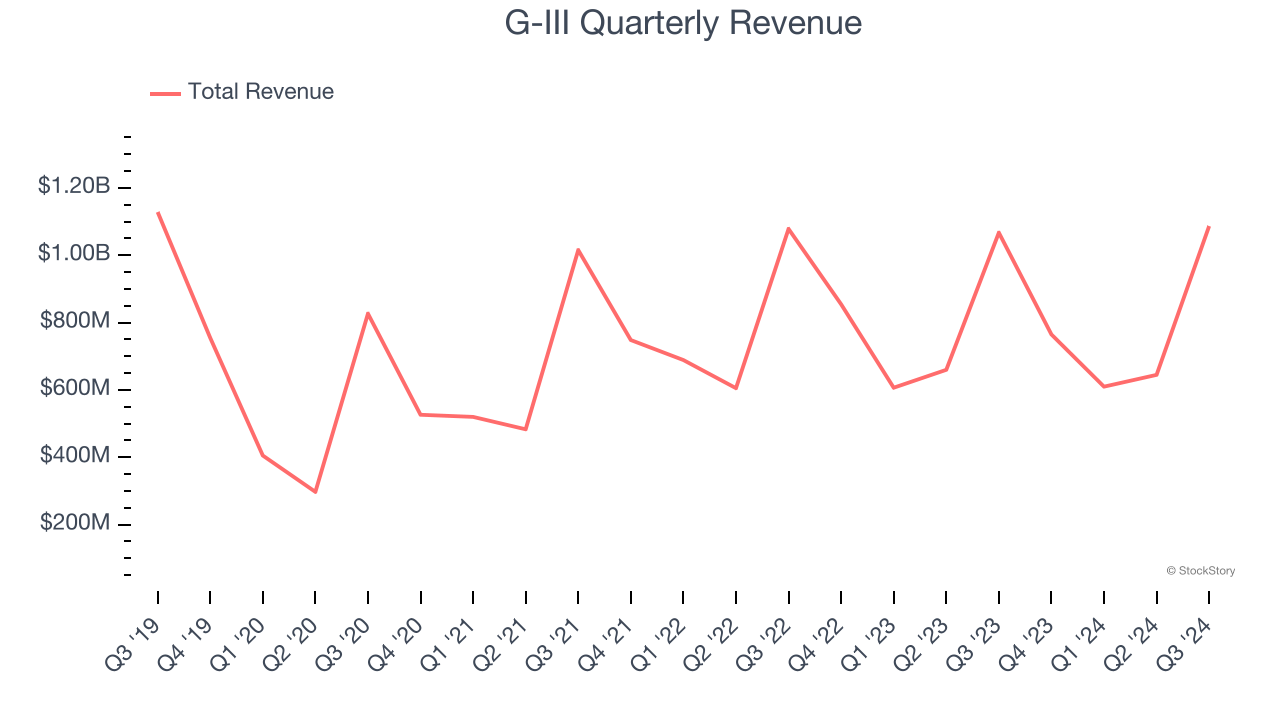

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, G-III struggled to consistently increase demand as its $3.11 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and signals it’s a low quality business.

2. Previous Growth Initiatives Haven’t Impressed

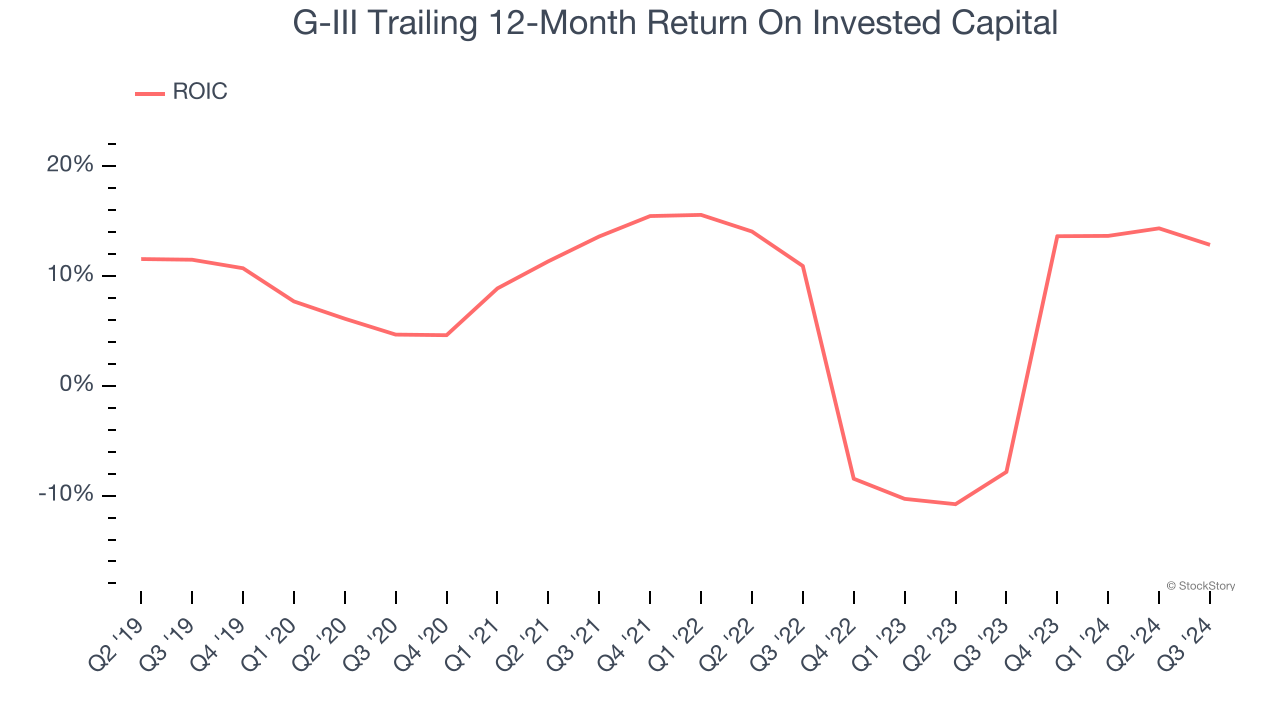

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

G-III historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

G-III doesn’t pass our quality test. That said, the stock currently trades at 6.7× forward price-to-earnings (or $26.65 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of G-III

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.