Luxury department store chain Nordstrom (NYSE:JWN) beat Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 2.2% year on year to $4.32 billion. Its non-GAAP profit of $1.10 per share was 18.6% above analysts’ consensus estimates.

Is now the time to buy Nordstrom? Find out by accessing our full research report, it’s free.

Nordstrom (JWN) Q4 CY2024 Highlights:

- Revenue: $4.32 billion vs analyst estimates of $4.30 billion (2.2% year-on-year decline, 0.6% beat)

- Adjusted EPS: $1.10 vs analyst estimates of $0.93 (18.6% beat)

- Adjusted EBITDA: $382 million vs analyst estimates of $396 million (8.8% margin, 3.5% miss)

- Operating Margin: 5.6%, in line with the same quarter last year

- Free Cash Flow Margin: 16.1%, up from 7.2% in the same quarter last year

- Locations: 377 at quarter end, up from 359 in the same quarter last year

- Same-Store Sales rose 4.7% year on year (2.2% in the same quarter last year)

- Market Capitalization: $4.00 billion

"Customers responded positively to the strength of our offering across both banners in the fourth quarter," said Erik Nordstrom, CEO of Nordstrom.

Company Overview

Known for its exceptional customer service that features a ‘no questions asked’ return policy, Nordstrom (NYSE:JWN) is a high-end department store chain.

Department Store

Department stores emerged in the 19th century to provide customers with a wide variety of merchandise under one roof, offering a convenient and luxurious shopping experience. They played an important role in the history of American retail and urbanization, and prior to department stores, retailers tended to sell narrow specialty and niche items. But what was once new is now old, and department stores are somewhat considered a relic of the past. They are being attacked from multiple angles–stagnant foot traffic at malls where they’ve served as anchors; more nimble off-price and fast-fashion retailers; and e-commerce-first competitors not burdened by large physical footprints.

Sales Growth

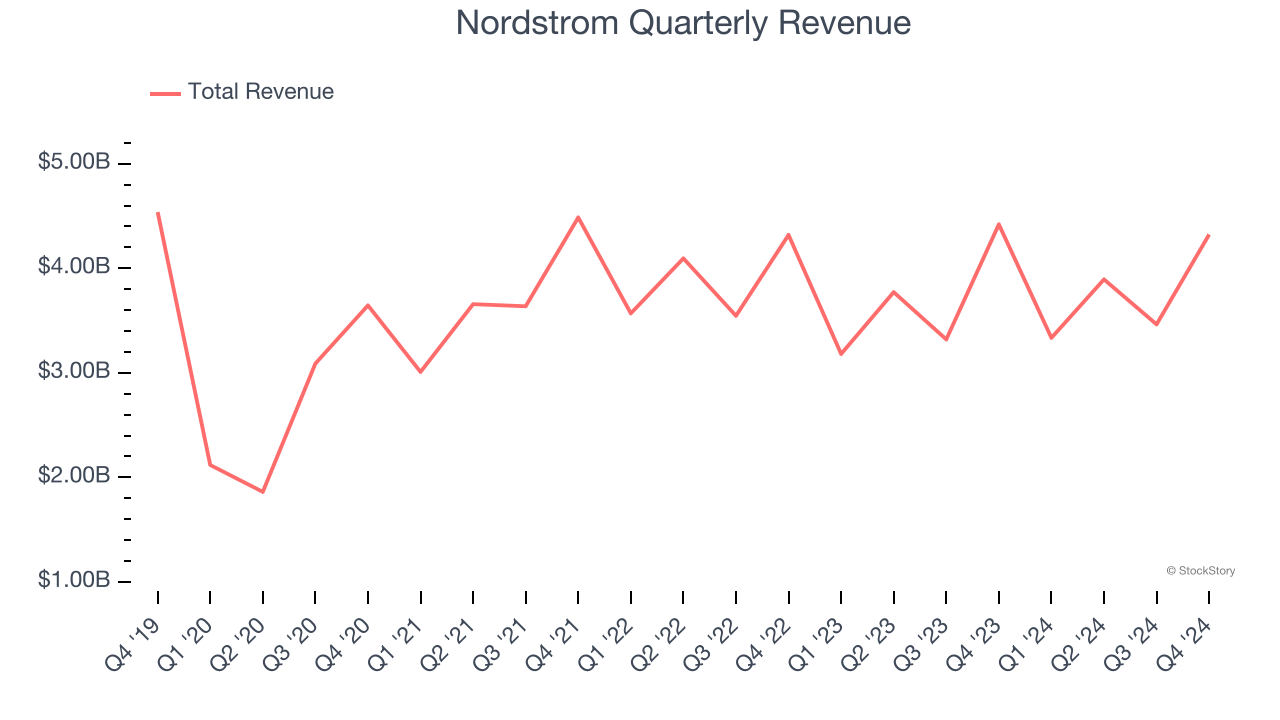

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $15.02 billion in revenue over the past 12 months, Nordstrom is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To accelerate sales, Nordstrom likely needs to lean into pricing or international expansion.

As you can see below, Nordstrom struggled to increase demand as its $15.02 billion of sales for the trailing 12 months was close to its revenue five years ago (we compare to 2019 to normalize for COVID-19 impacts). This was surprising given it opened new stores to expand its reach.

This quarter, Nordstrom’s revenue fell by 2.2% year on year to $4.32 billion but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months. Although this projection implies its newer products will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

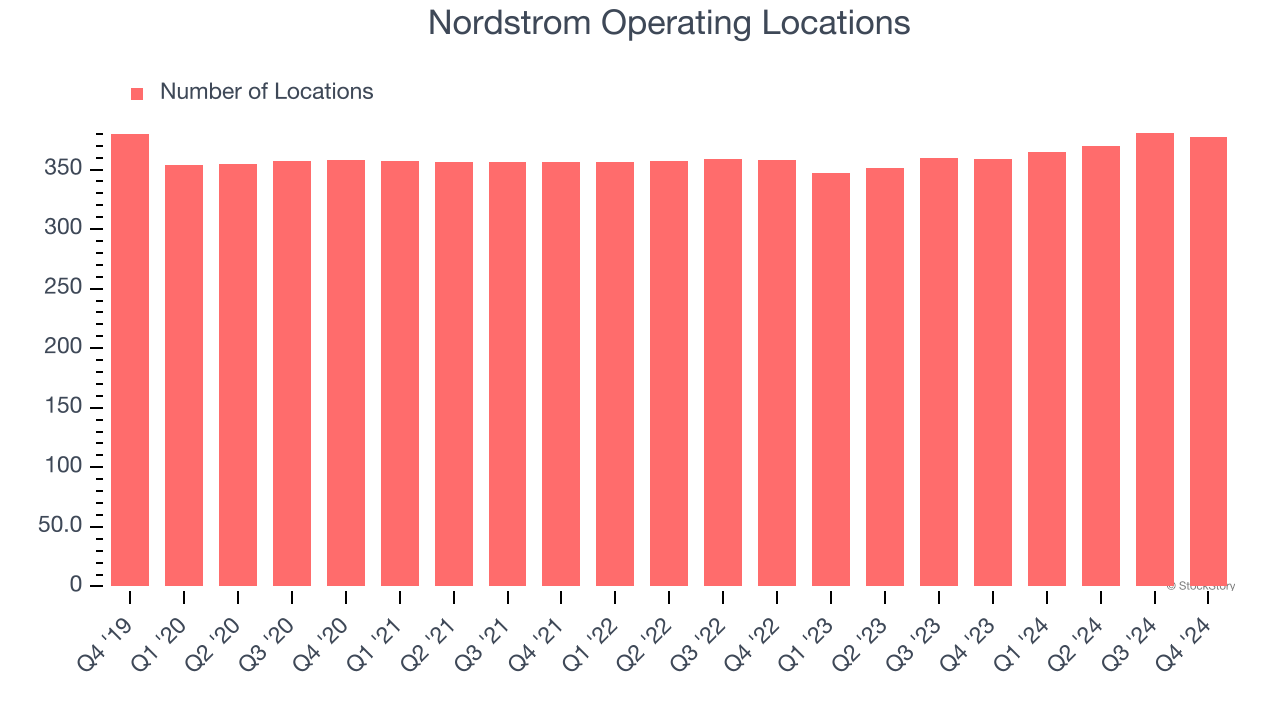

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Nordstrom sported 377 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 2.2% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

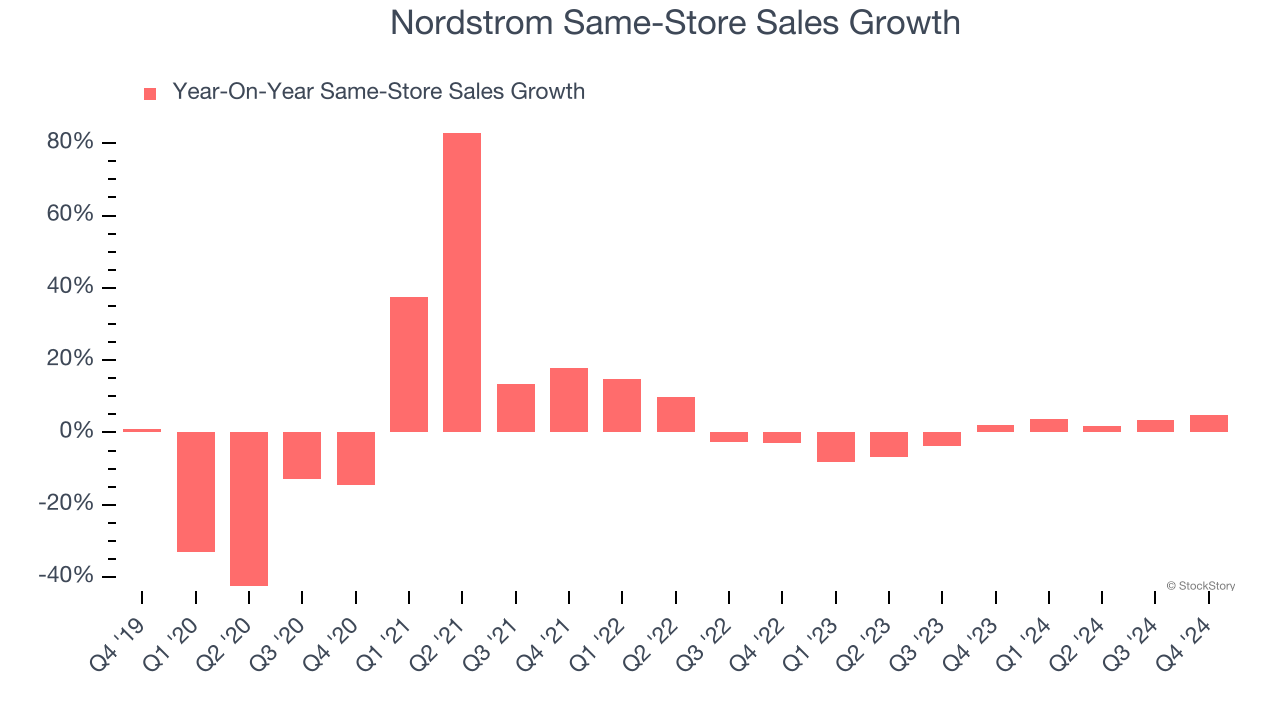

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Nordstrom’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. Nordstrom should consider improving its foot traffic and efficiency before expanding its store base.

In the latest quarter, Nordstrom’s same-store sales rose 4.7% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Nordstrom’s Q4 Results

We were impressed by how significantly Nordstrom blew past analysts’ gross margin expectations this quarter. We were also glad its revenue and EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $24.25 immediately after reporting.

Big picture, is Nordstrom a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.