As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the content delivery industry, including Akamai (NASDAQ:AKAM) and its peers.

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

The 4 content delivery stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.5% since the latest earnings results.

Weakest Q4: Akamai (NASDAQ:AKAM)

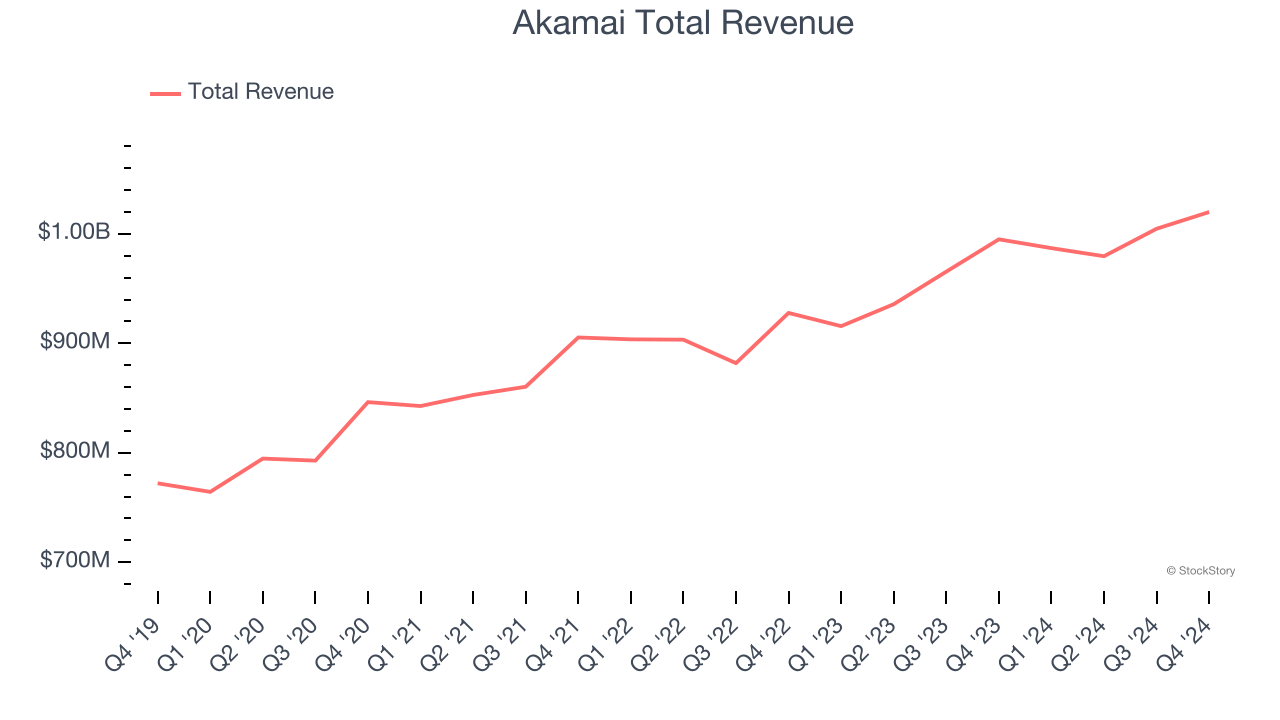

Founded in 1999 by two engineers from MIT, Akamai (NASDAQ:AKAM) provides software for organizations to efficiently deliver web content to their customers.

Akamai reported revenues of $1.02 billion, up 2.5% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with full-year guidance of slowing revenue growth and full-year EPS guidance missing analysts’ expectations.

"Akamai delivered a solid fourth quarter, demonstrating robust profitability and sustained momentum across our security and cloud computing solutions," said Dr. Tom Leighton, Akamai's Chief Executive Officer.

Akamai delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The stock is down 17.3% since reporting and currently trades at $81.09.

Read our full report on Akamai here, it’s free.

Best Q4: F5 (NASDAQ:FFIV)

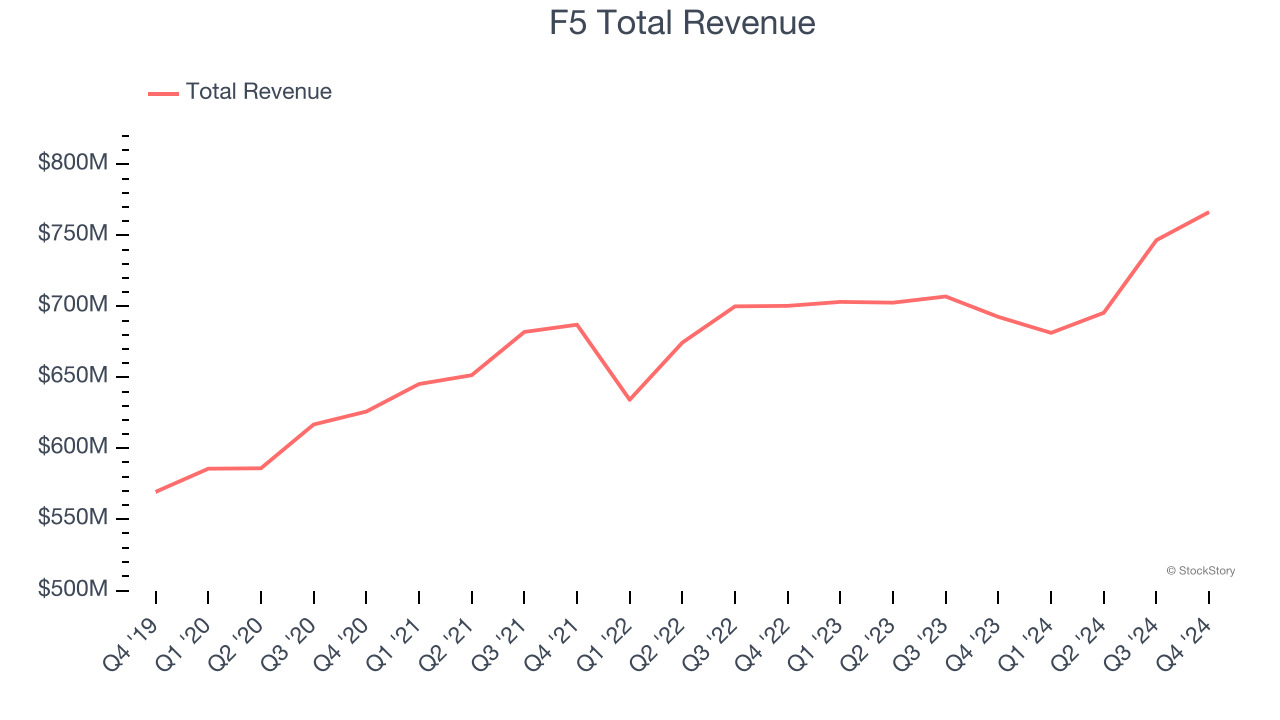

Initially started as a hardware appliances company in the late 1990s, F5 (NASDAQ:FFIV) makes software that helps large enterprises ensure their web applications are always available by distributing network traffic and protecting them from cyberattacks.

F5 reported revenues of $766.5 million, up 10.7% year on year, outperforming analysts’ expectations by 7.2%. The business had a strong quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

F5 scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.7% since reporting. It currently trades at $277.01.

Is now the time to buy F5? Access our full analysis of the earnings results here, it’s free.

Fastly (NYSE:FSLY)

Founded in 2011, Fastly (NYSE:FSLY) provides content delivery and edge cloud computing services, enabling enterprises and developers to deliver fast, secure, and scalable digital content and experiences.

Fastly reported revenues of $140.6 million, up 2% year on year, exceeding analysts’ expectations by 1.5%. Still, it was a softer quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ EBITDA estimates.

Fastly delivered the highest full-year guidance raise but had the slowest revenue growth in the group. As expected, the stock is down 35.4% since the results and currently trades at $6.51.

Read our full analysis of Fastly’s results here.

Cloudflare (NYSE:NET)

Founded by two grad students of Harvard Business School, Cloudflare (NYSE:NET) is a software-as-a-service platform that helps improve the security, reliability, and loading times of internet applications.

Cloudflare reported revenues of $459.9 million, up 26.9% year on year. This number topped analysts’ expectations by 1.8%. Aside from that, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but full-year EPS guidance missing analysts’ expectations.

Cloudflare achieved the fastest revenue growth among its peers. The stock is flat since reporting and currently trades at $141.73.

Read our full, actionable report on Cloudflare here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.