Premium payment card manufacturer CompoSecure (NASDAQ:CMPO) missed Wall Street’s revenue expectations in Q4 CY2024, with sales flat year on year at $100.9 million. Its non-GAAP profit of $0.20 per share was 6.5% below analysts’ consensus estimates.

Is now the time to buy CompoSecure? Find out by accessing our full research report, it’s free.

CompoSecure (CMPO) Q4 CY2024 Highlights:

- Revenue: $100.9 million vs analyst estimates of $102.5 million (flat year on year, 1.6% miss)

- Adjusted EPS: $0.20 vs analyst expectations of $0.21 (6.5% miss)

- Adjusted EBITDA: $33.61 million vs analyst estimates of $31 million (33.3% margin, 8.4% beat)

- Operating Margin: 15.5%, down from 30.6% in the same quarter last year

- Market Capitalization: $1.16 billion

Company Overview

Pioneering the metal credit card revolution that began with the American Express Centurion card in 2003, CompoSecure (NASDAQ:CMPO) designs and manufactures premium metal payment cards and secure authentication solutions for financial institutions and digital asset storage.

Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $420.6 million in revenue over the past 12 months, CompoSecure is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

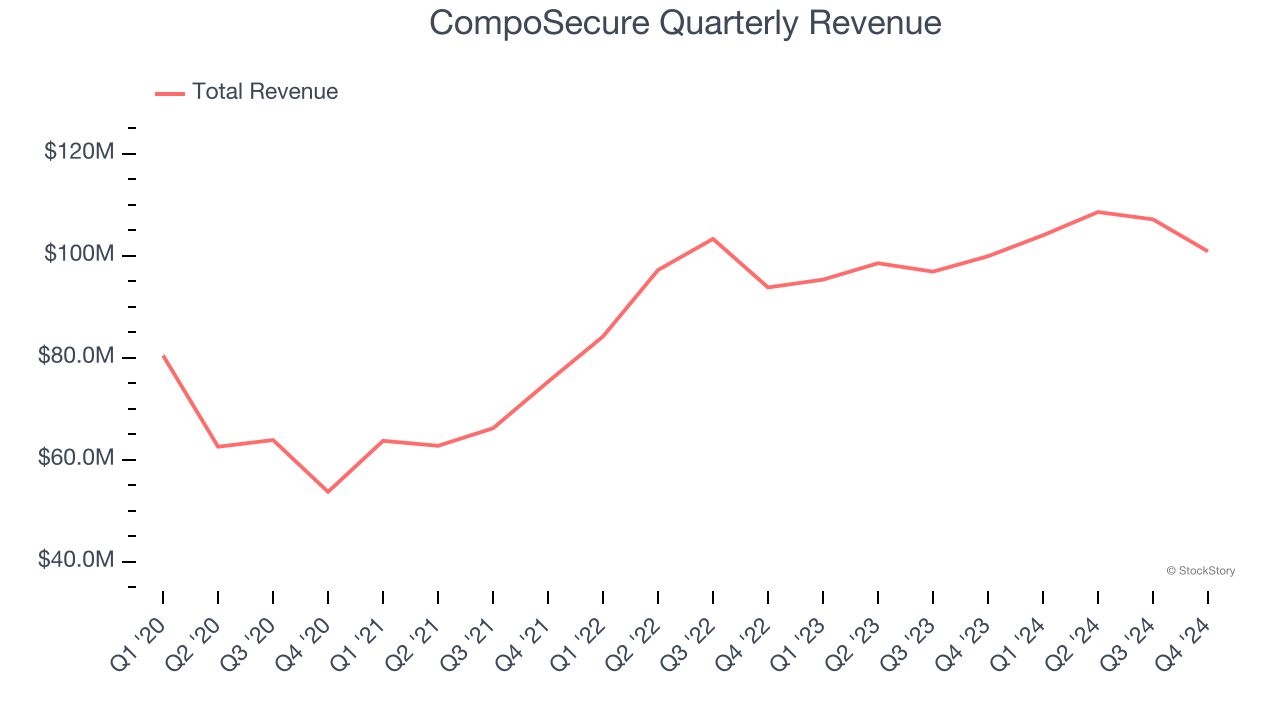

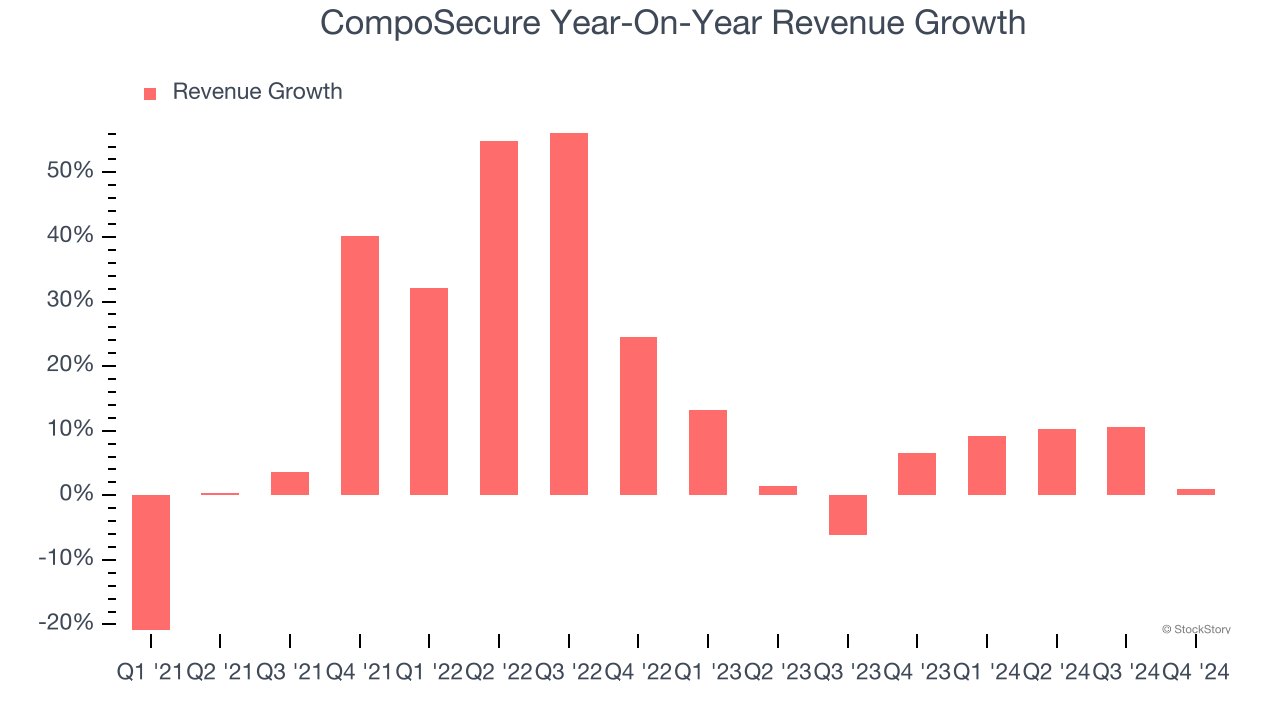

As you can see below, CompoSecure’s 12.7% annualized revenue growth over the last four years was excellent. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. CompoSecure’s annualized revenue growth of 5.4% over the last two years is below its four-year trend, but we still think the results were respectable.

This quarter, CompoSecure’s $100.9 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. This projection is above average for the sector and implies its newer products and services will catalyze better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

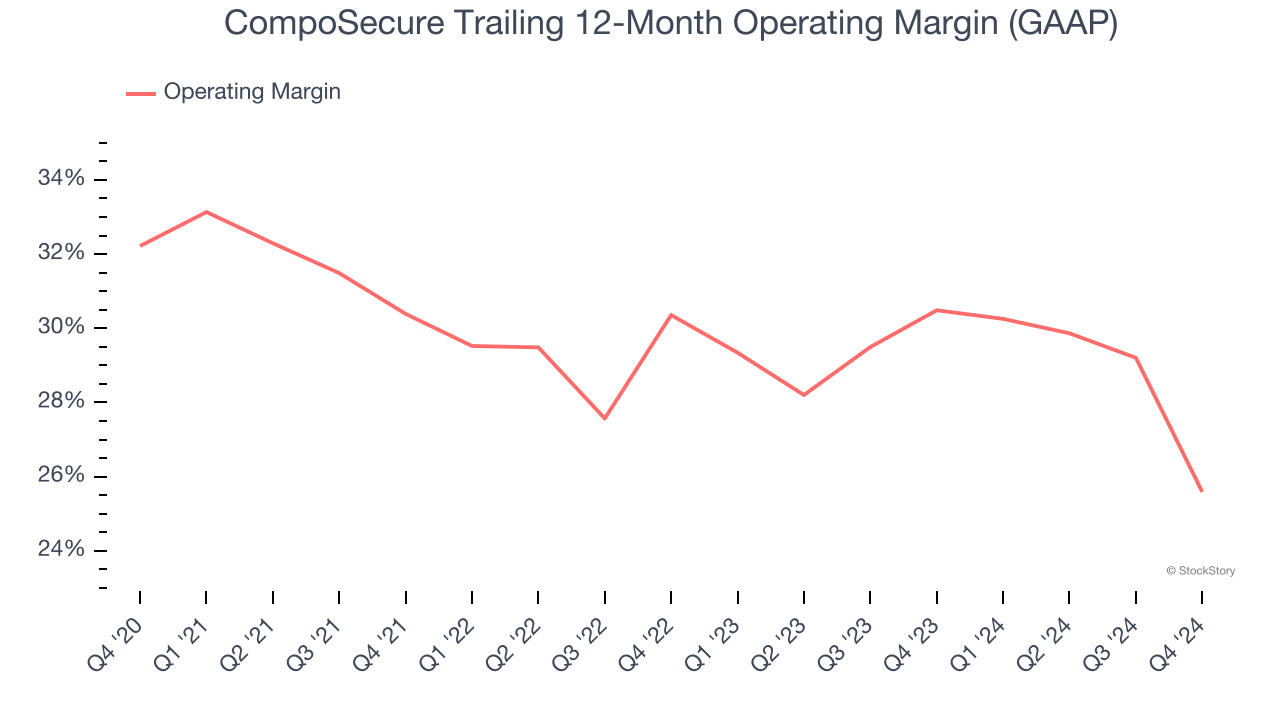

CompoSecure has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 29.5%.

Looking at the trend in its profitability, CompoSecure’s operating margin decreased by 6.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, CompoSecure generated an operating profit margin of 15.5%, down 15.1 percentage points year on year. This contraction shows it was recently less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

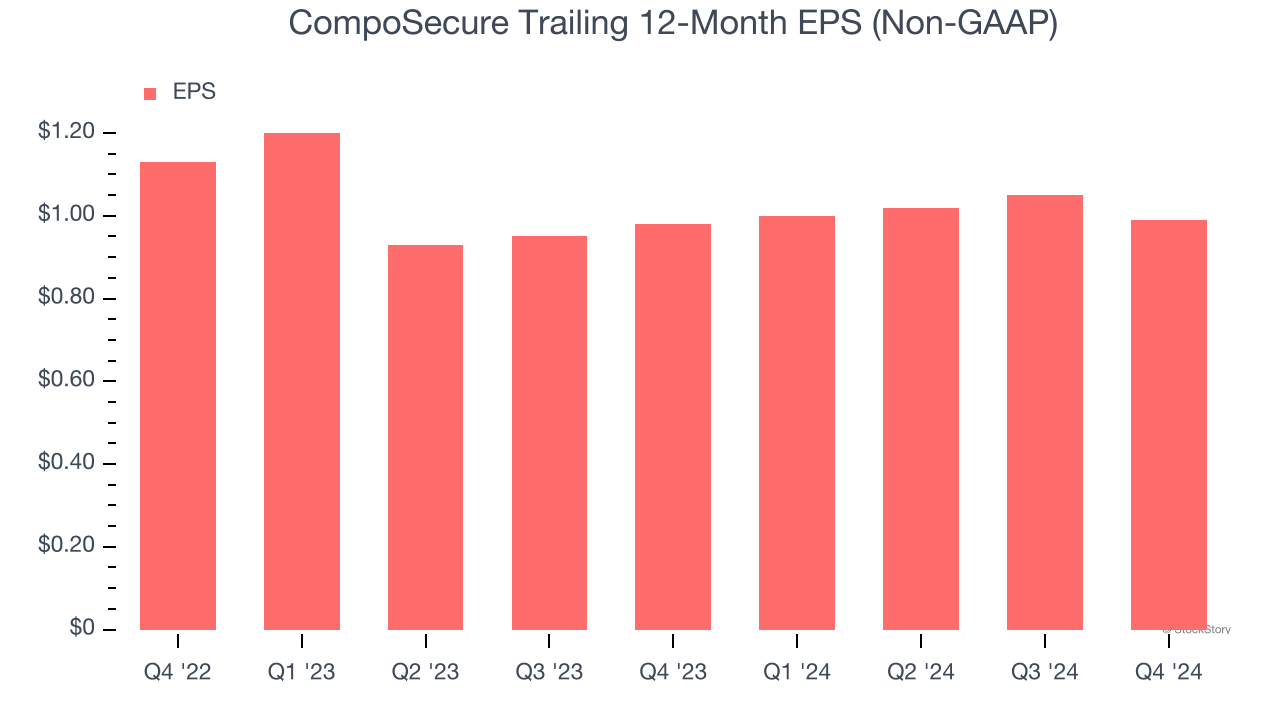

CompoSecure’s full-year EPS dropped 13.2%, or 6.4% annually, over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, CompoSecure’s low margin of safety could leave its stock price susceptible to large downswings.

In Q4, CompoSecure reported EPS at $0.20, down from $0.26 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects CompoSecure’s full-year EPS of $0.99 to grow 9.5%.

Key Takeaways from CompoSecure’s Q4 Results

We struggled to find many positives in these results. Its EPS missed significantly and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.6% to $11.34 immediately following the results.

CompoSecure may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.