Fresh produce company Dole (NYSE:DOLE) announced better-than-expected revenue in Q1 CY2025, but sales fell by 1% year on year to $2.10 billion. Its non-GAAP profit of $0.35 per share was 10.7% below analysts’ consensus estimates.

Is now the time to buy Dole? Find out by accessing our full research report, it’s free.

Dole (DOLE) Q1 CY2025 Highlights:

- Revenue: $2.10 billion vs analyst estimates of $2.05 billion (1% year-on-year decline, 2.4% beat)

- Adjusted EPS: $0.35 vs analyst expectations of $0.39 (10.7% miss)

- Adjusted EBITDA: $104.8 million vs analyst estimates of $101.9 million (5% margin, 2.8% beat)

- EBITDA guidance for the full year is $380 million at the midpoint, below analyst estimates of $384.6 million

- Operating Margin: 3.2%, in line with the same quarter last year

- Free Cash Flow was -$131.6 million compared to -$53.19 million in the same quarter last year

- Market Capitalization: $1.40 billion

Company Overview

Known for its delicious pineapples and Hawaiian roots, Dole (NYSE:DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $8.45 billion in revenue over the past 12 months, Dole is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Dole to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

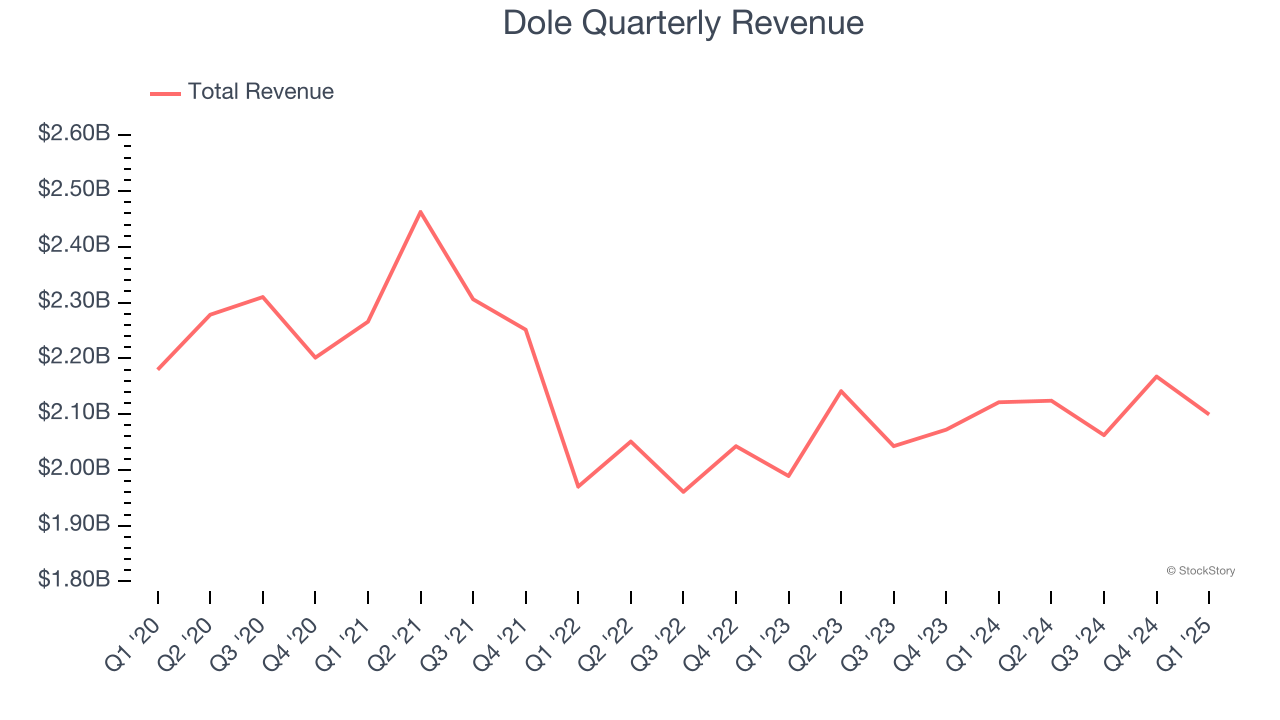

As you can see below, Dole’s demand was weak over the last three years. Its sales fell by 2% annually, a tough starting point for our analysis.

This quarter, Dole’s revenue fell by 1% year on year to $2.10 billion but beat Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products will fuel better top-line performance, it is still below the sector average.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

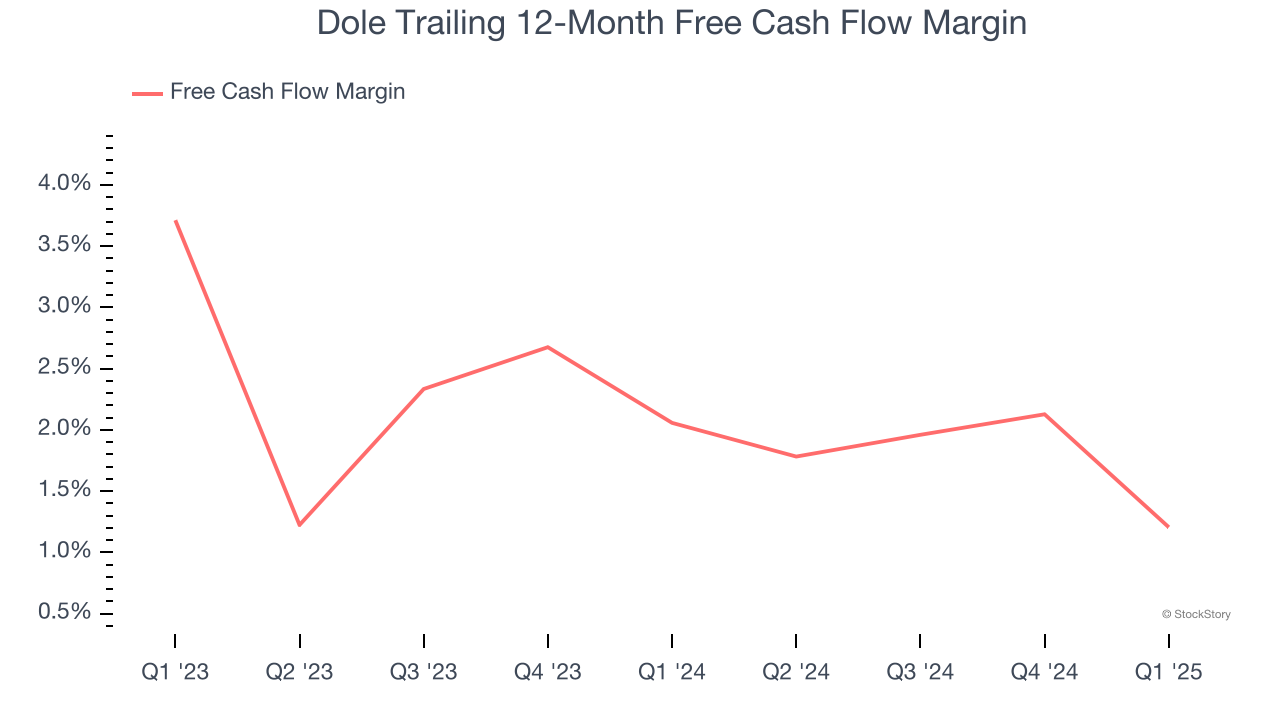

Dole has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.6%, subpar for a consumer staples business.

Taking a step back, we can see that Dole failed to improve its margin over the last year. Its unexciting margin and trend likely have shareholders hoping for a change.

Dole burned through $131.6 million of cash in Q1, equivalent to a negative 6.3% margin. The company’s cash burn increased from $53.19 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Key Takeaways from Dole’s Q1 Results

It was encouraging to see Dole beat analysts’ revenue expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed significantly and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 4% to $14.14 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.