SolarEdge Technologies, Inc. - Common Stock (SEDG)

35.92

+2.64 (7.93%)

NASDAQ · Last Trade: Feb 8th, 10:12 AM EST

Detailed Quote

| Previous Close | 33.28 |

|---|---|

| Open | 34.10 |

| Bid | 35.80 |

| Ask | 36.00 |

| Day's Range | 34.10 - 36.58 |

| 52 Week Range | 11.00 - 48.60 |

| Volume | 3,028,337 |

| Market Cap | 1.99B |

| PE Ratio (TTM) | -3.726 |

| EPS (TTM) | -9.6 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 2,806,598 |

Chart

About SolarEdge Technologies, Inc. - Common Stock (SEDG)

SolarEdge Technologies is a leading provider of photovoltaic inverter solutions, which optimize the energy output of solar panels. The company focuses on enhancing the efficiency of solar energy systems by enabling better performance monitoring and control. In addition to inverters, SolarEdge also offers innovative technology and services that include energy storage solutions and electric vehicle charging systems, contributing to the seamless integration of renewable energy sources into homes and businesses. With a commitment to sustainability, SolarEdge plays a key role in advancing the adoption of solar energy worldwide. Read More

News & Press Releases

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices. This rally was fueled by a recovery in technology stocks and a significant bounce in Bitcoin, which stabilized after losing over half its value from its October peak. Investor sentiment was also lifted by a surprising improvement in U.S. consumer sentiment and the realization that massive AI-related capital expenditure, such as Amazon's planned $200 billion, directly benefits chipmakers like Nvidia and Broadcom. These "pick-and-shovel" winners jumped as much as 7%, helping the S&P 500 edge back into positive territory for 2026.

The highlight of the day was the Dow Jones Industrial Average, which surged and crossed the historic 50,000 threshold for the first time.

Via StockStory · February 6, 2026

Sun Valley, CA - Homeowners across Southern California are increasingly opting for solar energy as a reliable, clean alternative to the traditional power grid, which continues to face mounting strain from extreme weather, rising energy demand, and aging infrastructure.

Via GetFeatured · February 5, 2026

As of February 5, 2026, Enphase Energy, Inc. (NASDAQ: ENPH) stands at a pivotal crossroads in the global energy transition. Once the undisputed "darling" of the solar sector during the early 2020s, the Fremont, California-based company is currently navigating the aftermath of a massive industry-wide inventory correction and a significant shift in the California regulatory [...]

Via Finterra · February 5, 2026

Sunrun’s stock has gained nearly 13% so far this year, building on the 98% jump in 2025 as the company’s solar products see steady demand.

Via Stocktwits · February 4, 2026

ENPH lagged SEDG all of last year, but analysts are seeing brighter prospects for Enphase due to its storage battery edge.

Via Stocktwits · February 3, 2026

SolarEdge Technologies, Inc. (NASDAQ: SEDG), a global leader in smart energy technology, will report financial results for the fourth quarter and the full year ended December 31, 2025 before market open on Wednesday, February 18, 2026. Management will host a conference call at 8:00 A.M. ET on Wednesday, February 18, 2026, to discuss these results.

By SolarEdge Technologies, Inc. · Via Business Wire · February 2, 2026

SolarEdge Technologies, Inc. (NASDAQ: SEDG), a global leader in smart energy technology, today announced the latest milestone in its international manufacturing and export strategy with the shipment of single-phase residential inverter products from its Austin, Texas facility to key European markets. The company commenced exports of the first U.S.-manufactured Single SKU residential inverter products to Europe in late 2025 to customers in Italy, France, and the Netherlands. Shipments of commercial and industrial (C&I) solar products from Florida are on track to begin in early 2026.

By SolarEdge Technologies, Inc. · Via Business Wire · January 29, 2026

A number of stocks jumped in the afternoon session after the US president announced a framework for a future deal with Greenland. Wall Street saw a broad-based rally, with the S&P 500 gaining 1.2% as investor concerns over global trade tensions eased. The positive sentiment followed an announcement that reversed course on plans to impose tariffs linked to Greenland, which had caused steep market losses earlier in the week. This recovery reflected renewed optimism in the market, as the threat of a widening trade conflict appeared to subside, encouraging investors to move back into equities.

Via StockStory · January 22, 2026

Did clean energy's 47% run signal a breakout last year?

Via The Motley Fool · January 21, 2026

SolarEdge’s 17.6% return over the past six months has outpaced the S&P 500 by 7.5%, and its stock price has climbed to $33.91 per share. This run-up might have investors contemplating their next move.

Via StockStory · January 18, 2026

As of January 16, 2026, Enphase Energy, Inc. (NASDAQ: ENPH) stands at a critical crossroads between its legacy as a residential solar pioneer and its future as a cornerstone of the global electrification and AI-driven energy transition. Once the darling of the "green premium" investment era, Enphase has spent the last 24 months navigating a [...]

Via Finterra · January 16, 2026

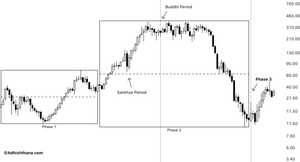

SolarEdge Technologies has been one of the sector's biggest laggards. Our analysis explains how an early structural deviation led to the stock's prolonged collapse and what lies ahead.

Via Benzinga · January 16, 2026

Via Benzinga · January 15, 2026

Shares of solar power systems company SolarEdge (NASDAQ:SEDG)

jumped 9.1% in the afternoon session after its positive momentum continued as TD Cowen upgraded the stock to "Buy" from "Hold" and raised its price target, citing progress in the company's turnaround plan.

Via StockStory · January 12, 2026

Just over a year ago, the future of SolarEdge Technologies (NASDAQ: SEDG) seemed eclipsed by a shadow of mounting debt, a massive inventory glut, and a plummeting stock price that had shed nearly 90% of its value from all-time highs. However, as of January 9, 2026, the narrative has shifted

Via MarketMinute · January 9, 2026

Shares of solar power systems company SolarEdge (NASDAQ:SEDG)

jumped 5.8% in the morning session after TD Cowen upgraded the stock to Buy from Hold. The firm also increased its price target on the solar technology company to $38 from $34.

Via StockStory · January 9, 2026

As we enter the first full week of 2026, the renewable energy sector finds itself at a historic inflection point. Enphase Energy, Inc. (NASDAQ: ENPH), once the undisputed darling of the solar industry, is currently navigating what analysts are calling the "Solar Winter." Today, January 9, 2026, Enphase sits at a valuation that would have [...]

Via PredictStreet · January 9, 2026

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance.

Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Via StockStory · January 8, 2026

Unpacking the biggest energy headlines and what they could mean for energy investors heading into 2026.

Via The Motley Fool · January 8, 2026

When Wall Street turns bearish on a stock, it’s worth paying attention.

These calls stand out because analysts rarely issue grim ratings on companies for fear their firms will lose out in other business lines such as M&A advisory.

Via StockStory · January 5, 2026

As of December 24, 2025, the renewable energy sector finds itself at a historic crossroads. While many clean energy stocks have weathered a turbulent eighteen months characterized by high interest rates and a sweeping shift in the U.S. political landscape, First Solar, Inc. (NASDAQ: FSLR) has emerged not just as a survivor, but as a [...]

Via PredictStreet · December 24, 2025

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · January 1, 2026

A number of stocks fell in the afternoon session after major indices pulled back from record highs reached the previous week.

Via StockStory · December 29, 2025

These have both outperformed the S&P 500 over time.

Via The Motley Fool · December 29, 2025

As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at renewable energy stocks, starting with SolarEdge (NASDAQ:SEDG).

Via StockStory · December 28, 2025