iShares MSCI ACWI ETF (ACWI)

144.75

+0.98 (0.68%)

NASDAQ · Last Trade: Jan 11th, 6:14 PM EST

Detailed Quote

| Previous Close | 143.77 |

|---|---|

| Open | 144.09 |

| Day's Range | 143.87 - 144.97 |

| 52 Week Range | 101.25 - 144.96 |

| Volume | 2,359,064 |

| Market Cap | - |

| Dividend & Yield | 2.470 (1.71%) |

| 1 Month Average Volume | 3,871,421 |

Chart

News & Press Releases

Here's Why This Israeli Investment Giant Is Betting $834 Million on Teva Stock

Via The Motley Fool · November 3, 2025

Israel’s Phoenix Financial Exits $169 Million Tower Semiconductor Stake After Stock's 99% Rally

Via The Motley Fool · November 3, 2025

Amplius Wealth Trims Global ETF but Keeps Core Exposure Through Flagship Fund

Via The Motley Fool · October 26, 2025

Nvidia (NVDA) surpasses Japan as 5th-largest market on MSCI ACWI. Its dominance highlights the role of AI in today's equity landscape.

Via Benzinga · October 7, 2025

Equity markets are becoming intrinsically riskier because they are becoming more concentrated.

Via Talk Markets · December 17, 2024

Labor Day in the U.S. marks the end of summer and a break for Wall Street. Markets, banks and institutions are closed, but international markets remain open.

Via Benzinga · September 2, 2024

MSCI will roll out a rejig of its ACWI and Emerging Markets indexes, adding 42 and removing 56 securities. ETFs linked to these indexes may experience temporary spikes in trading volumes.

Via Benzinga · August 13, 2025

US-listed international ETFs hit 52-week highs as investors shift towards global equities amid macroeconomic shifts and geopolitical realignments.

Via Benzinga · May 21, 2025

Via Talk Markets · April 12, 2025

Hang Seng Index in bear market territory, losing 20% after US tariffs on Chinese imports. ETFs with exposure to Asia, Tech and Agriculture under pressure.

Via Benzinga · April 10, 2025

AT&T (T) gets FCC approval to replace old copper home phone lines with wireless technology, expanding 5G network and fiber coverage for growth.

Via Benzinga · December 24, 2024

Walmart Inc (NYSE: WMT) partners with Meituan (OTC: MPNGF) for e-commerce delivery in China. Walmart's China sales account for 50% of total sales.

Via Benzinga · December 17, 2024

The most significant moves were in the FX and rates markets, with the 10-year yield climbing by 16 basis points to close around 4.44%, breaking above the long-term downtrend that began in October 2023.

Via Talk Markets · November 6, 2024

Via Talk Markets · October 30, 2024

The market is at a major inflection point in macro fundamentals, offering investors a once-in-a-generation opportunity to reposition portfolios. To put this opportunity into perspective, here is a look at the best trades of the past 50 years.

Via Talk Markets · October 13, 2024

Concerns over a slowing economy and labor market at the beginning of the quarter firmed investors’ beliefs that interest rate cuts were on the way.

Via Talk Markets · August 1, 2024

Discover three top global stocks as a smart hedge against Wall Street volatility, offering diversification and resilience in uncertain times.

Via InvestorPlace · July 16, 2024

The traditional 60/40 investment portfolio recorded 13% growth in 2023, its third-best year since 2008. Investors ponder if favorable conditions in H2 of 2023 will continue in 2024.

Via Benzinga · December 28, 2023

The 60/40 portfolio strategy is not dead. Here are three ways to play the long-time investment asset-allocation philosophy.

Via InvestorPlace · December 6, 2023

The S&P 500, for the most part, has consolidated the last two trading sessions and failed for a second day at 4,270.

Via Talk Markets · October 5, 2023

There are encouraging signs that the “totally bullish” situation is looking much shakier. For example, the Dow Jones Utilities could be one of the most potent reversal patterns I’ve seen in years.

Via Talk Markets · August 13, 2023

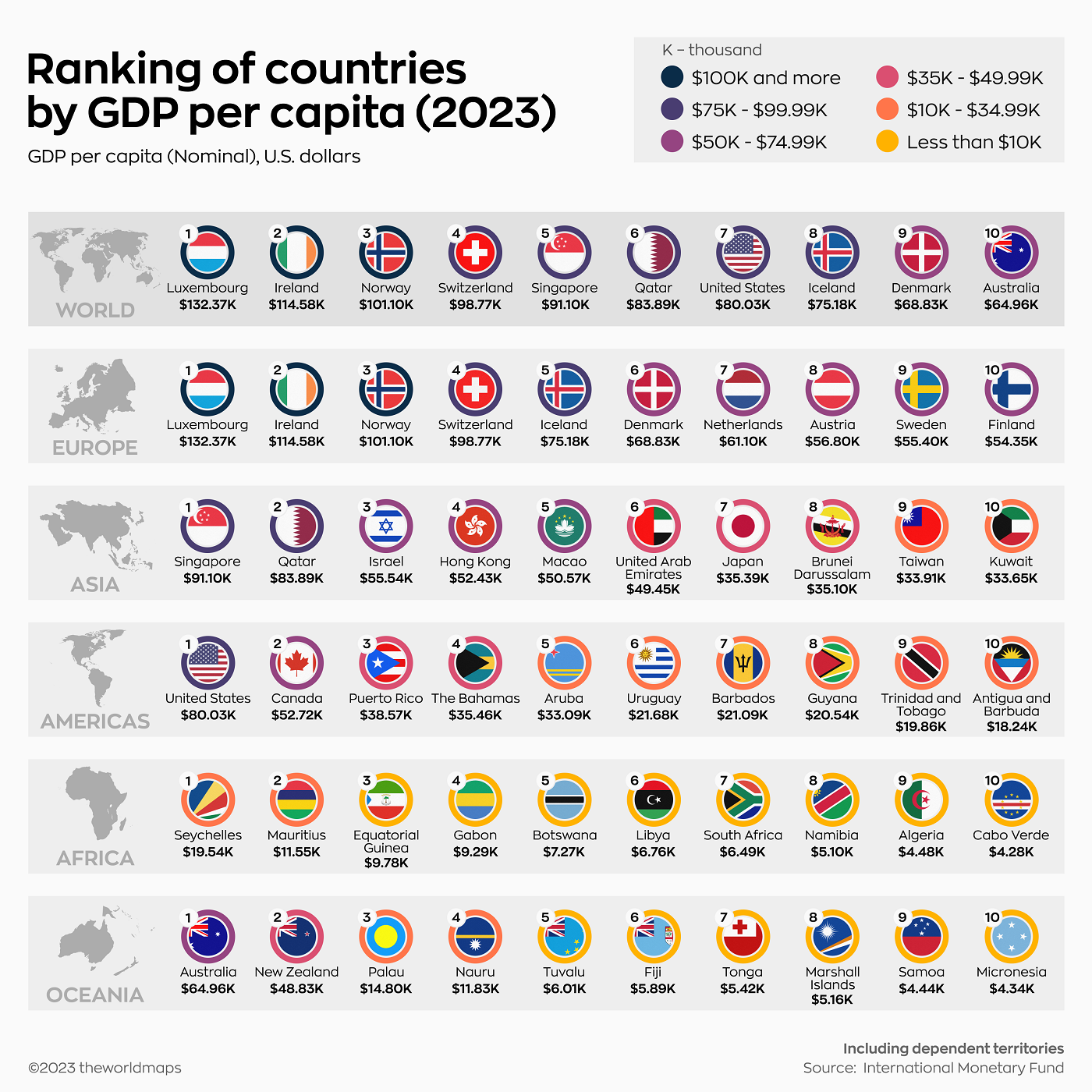

GDP per capita, while useful, doesn’t account for such things as strength of local currency, or price differencs between countries (e.g. plentiful/cheap vs scarce/expensive). Economists use Purchasing Power Parity (PPP) to show relative prosperity.

Via Talk Markets · June 25, 2023

Either the bulls or the bears are going to be very, very happy with the release of this tension within the next few weeks. I just can’t for the life of me figure out who.

Via Talk Markets · May 7, 2023

Despite growing concerns with U.S. regional banks, a debt ceiling debate standoff, another interest rate hike, and signs that the U.S. economy might be cooling down, a better-than-expected Q1 earnings season has kept investors in the market.

Via Talk Markets · May 6, 2023

As investors appeared to ignore rising Treasury yields, stocks generally managed to remain on the plus-side for the fund-flows week.

Via Talk Markets · March 9, 2023