iShares Core U.S. Aggregate Bond ETF (AGG)

100.16

+0.22 (0.22%)

NYSE · Last Trade: Jan 11th, 8:04 AM EST

Wealth Enhancement’s latest 13F filing highlights USVM as a deliberate tool for accessing small- and mid-cap stocks, a move that blends both value and momentum while keeping volatility in check.

Via The Motley Fool · January 8, 2026

Acorns Advisers increased its shares in this top utility ETF. Should investors be concerned?

Via The Motley Fool · January 5, 2026

Looking for dry powder you can deploy fast without riding the stock market roller coaster? Here is where to park your cash without taking stock-level risk.

Via The Motley Fool · December 23, 2025

Via Talk Markets · March 4, 2025

USMC is now 4.92% of fund AUM and remains the largest holding.

Via The Motley Fool · December 11, 2025

Procter & Gamble's stock price is higher over the past five years, but investors would have done better with the S&P 500 or consumer staples ETFs.

Via The Motley Fool · December 6, 2025

VOO, SPY and QQQ are driving record U.S. ETF inflows as the Big Three cement their hold on the $13T market.

Via Benzinga · November 17, 2025

Passive income investments can get you on the path toward becoming a millionaire.

Via The Motley Fool · November 9, 2025

Via The Motley Fool · October 15, 2025

These ETFs can help me have a more financially secure retirement.

Via The Motley Fool · October 5, 2025

September's stock slump has a history. This year, ETFs like SPY, TLT, and VIXY could be at the center as investors hedge against rising volatility.

Via Benzinga · August 29, 2025

A decade ago, the idea of putting Bitcoin or commodities like gold in a retirement plan would've sounded insane. Today, President Donald Trump has the opportunity to radically reshape the way Americans save for retirement.

Via Benzinga · July 21, 2025

Via The Motley Fool · June 28, 2025

Via Benzinga · April 13, 2025

The biggest Treasury bond ETFs moved higher, reminding investors why bonds remain a cornerstone of portfolio stability.

Via Benzinga · April 11, 2025

The long-run expected total return for the Global Market Index fell again in March, dropping to an annualized 6.9% vs. the previous month’s 7.1%.

Via Talk Markets · April 2, 2025

Investors should prepare for a 2008-style crisis.Benzinga warns of potential economic crisis predicted by Peter Schiff in 2008. Tariffs, rising interest rates, misguided Fed policy may cause trouble.

Via Benzinga · March 31, 2025

In this week's video, we'll review the latest charts and data to help us answer the question, will the April 2nd reciprocal tariffs bring additional pain for investors?

Via Talk Markets · March 22, 2025

The long-run expected return for the Global Market Index (GMI) remained above 7% for a third straight month in January, ticking higher vs. December’s estimate.

Via Talk Markets · February 4, 2025

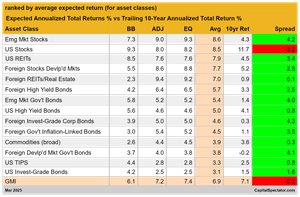

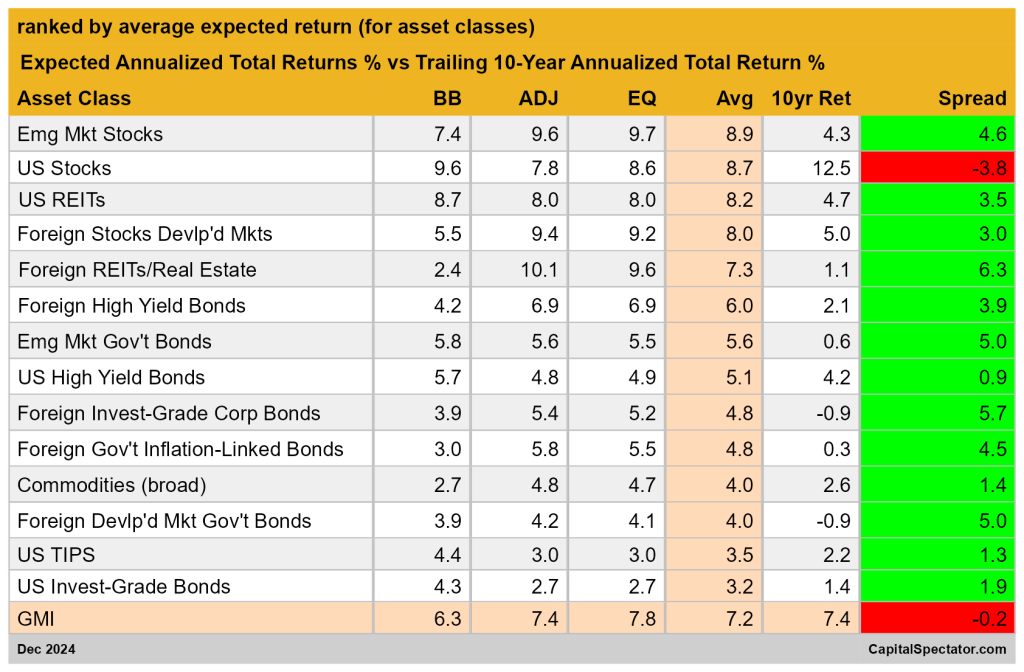

The expected return over the long run for the Global Market Index held steady in December vs. the previous month.

Via Talk Markets · January 3, 2025

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat.

Via Talk Markets · December 10, 2024

With markets rising steadily all year, it is unsurprising to witness investors lulled into an elevated sense of complacency.

Via Talk Markets · December 8, 2024

The long-term performance forecast for the Global Market Index (GMI) continued to increase in November, marking a full reversal of the recent slide in ex ante data.

Via Talk Markets · December 3, 2024

ETF growth is reshaping finance, assets nearing $15 trillion. JPMorgan analysis delves into investor behavior, market risks. Top 10 takeaways.

Via Benzinga · November 21, 2024